In market and consumer research, segmentation is the process of categorizing consumers, customers, companies, or markets into distinct groups or segments based on your desired criteria.

The hope is that each member of a segment shares a set of characteristics with others in their segment, characteristics that are distinct from members of the other segments. Oranges with oranges, and bananas with bananas.

Why is segmentation so important?

Well, we know that people don’t care about everything. They care about things that are particularly relevant to their situation – their demographics, their psychographics, their hobbies, their political views, their geographical location.

Well, we know that people don’t care about everything. They care about things that are particularly relevant to their situation – their demographics, their psychographics, their hobbies, their political views, their geographical location.

Rather than broadcasting the same market messages to everyone or the offering the same product to everyone, segmentation allows marketers and advertisers to increase the odds that people will notice, pay attention to, and act on messages they see because those messages are particularly relevant to them. That means directing chew toy promotions to people who have dogs, gardening products to gardeners who love succulents, and restaurant promotions to area residents who love Indian food. This targeted approach leads to increased appeal, trial, and repurchase.

As with any research study, segmentation research is fluid. In response to cultural, political, social, and economic shifts over time, consumer opinions and behaviors evolve in response.

The behaviors and targeting strategies of marketers, advertisers, and business leaders must also evolve in response. When major events such as pandemics and extreme economic uncertainty take place, existing segmentation strategies can quickly become irrelevant, necessitating a refresh before a typical 3 to 5 year period is up.

.

.

What and who can be segmented?

Just about anything can be segmented!

- Consumers: Consumers are people who use products and services from food and beverage to personal care items to financial services – basically everyone! Consumers can be segmented into an infinite number of categories depending on your unique needs.

- Customers: Customers are a segment of consumers. They are the people who use or buy the specific product YOU sell. Ideally, you want to find segments of consumers that could become your customers.

- Markets: Markets can also be segmented based on many criteria to find geographical regions, retailer categories, or channel categories where your product or service would be best suited for use.

.

.

What are the key benefits of segmentation?

There are many benefits of a market segmentation but what follows are a few key benefits. Segmentation allows you to:

There are many benefits of a market segmentation but what follows are a few key benefits. Segmentation allows you to:

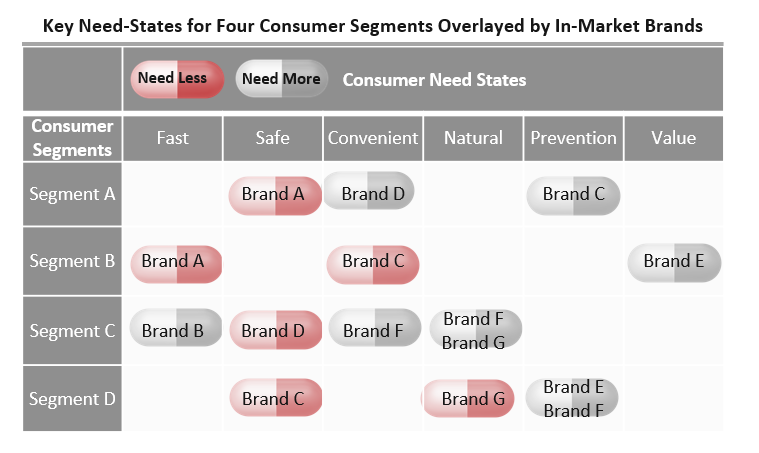

- Identify most and least valuable people: Segmentation research will help you identify nuggets of gold, those groups of people who have the highest ROI, so you can increase your targeting and resourcing efforts with them. Similarly, segmentation will help you identify who has the weakest ROI so you can consider decreasing any resources focused on them.

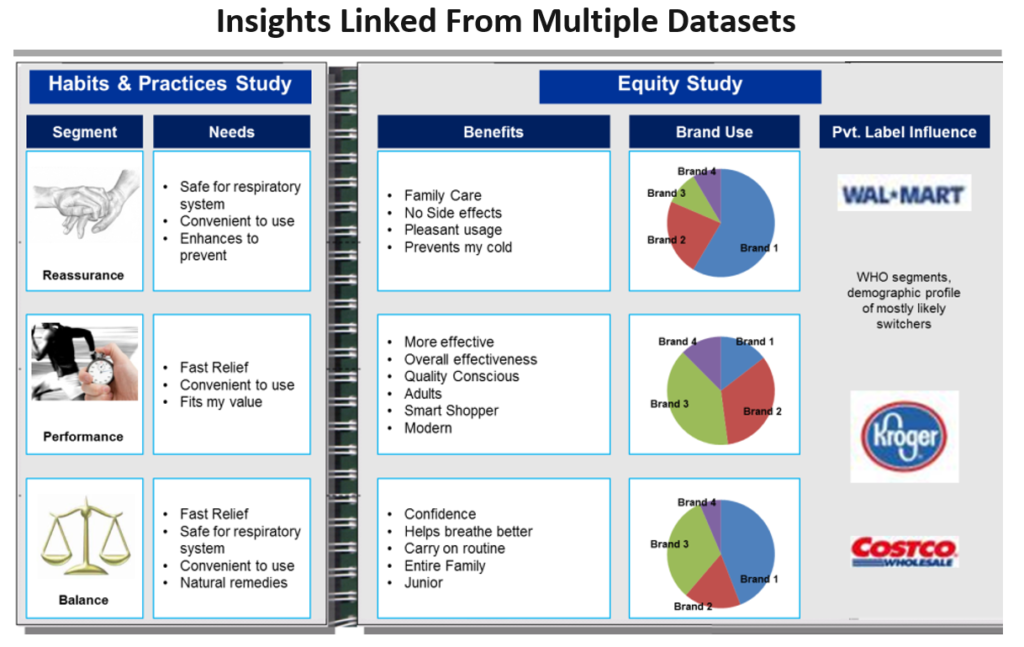

- Identify unknown people: Segmentation research may identify an important group of consumers you were previously unaware of, or a product feature that warrants extra or different messaging or promotions.

- Improve connections with people: Following through on segmentation strategies proves to consumers you understand and will address their unique needs. This increases your likeability and top of mind awareness.

- Create products that are more desirable: When you understand the unique needs of various segments, you can improve existing and create new products and services that are better equipped to meet their needs, leading to increased trial and repurchase.

- Create promotions, pricing, and placements that are more desirable: Once you’ve created or improved a product, you will be better able to identify the best pricing and promotion models, and best channels for each segment. In other words, fewer dollars are wasted on ineffective strategies and more dollars go towards effective strategies.

.

.

What are the key features of a successful segmentation model?

Consumers, customers, companies, and markets can be described in many different ways. However, without these four characteristics, a segmentation strategy is sure to fail. As you build your model, make sure it incorporates each of these four requirements.

Consumers, customers, companies, and markets can be described in many different ways. However, without these four characteristics, a segmentation strategy is sure to fail. As you build your model, make sure it incorporates each of these four requirements.

- Operationalizable: Each segment must have describable characteristics. For example, it’s impossible to target people who have some kind of, strange, well, you know, emotional sort of feeling about soup. However, you CAN act on people who visit a soup shop every month, who buy soup once a week, or who select “Strongly agree” to a question like “Eating soup makes me feel happy.”

- Actionable: Segments must be described in a way that allows members to be found. For instance, without knowing where someone lives, you cannot deliver a soup coupon to their door. Or, if they don’t use a TV, it makes no sense to create a television commercial for them about soup.

- Size of Opportunity: Segments must be large enough to warrant the cost of targeting them. You may be able to identify 400 people who would be interested in soup made with insects but…

- Value of Opportunity: Segments must have sufficient value to warrant the cost of targeting them. Targeting a segment of people who are interested in soup made with insects is not worth the investment if they’ll only buy it once as joke.

.

.

What are the types of segmentation models?

The best segmentation models are effective because they incorporates a range of complementary demographic, geographic, psychographic, and behavioral variables.

If you’re a visual / audio learner, here’s a quick video summary for you.

.

.

.

Demographic Variables

Common variables: Age, gender, ethnicity, education, income, occupation, family size, religion, language, dialect, life stage.

Common variables: Age, gender, ethnicity, education, income, occupation, family size, religion, language, dialect, life stage.

Source of data: Questionnaires, focus groups, census data, third party data, data aggregators.

Because demographic data is so readily available, segmenting people based solely on their demographics is the simplest and most common strategy. Retirement homes target people based on age, and children’s campgrounds target people based on the presence of children in a home.

But, ease of targeting is definitely not always reflective of the quality of the targeting. Some older people move in with their families and not all families can afford to send their children to camp.

.

Geographic Variables

Common variables: Region, country, state, city, neighborhood, zip.

Common variables: Region, country, state, city, neighborhood, zip.

Source of data: Postal lists, mailing lists, census data, third party data.

Geographical data is also fairly easy to acquire and particularly easy to action on. It’s helpful for many products and services that are associated with distinct geographical regions. Restaurants target people in specific neighbourhoods with door-to-door flyers, children’s camps target families in specific cities, and some products may only be legal in specific countries. For increased relevance, geographic segmentation is often combined with demographic segmentation.

.

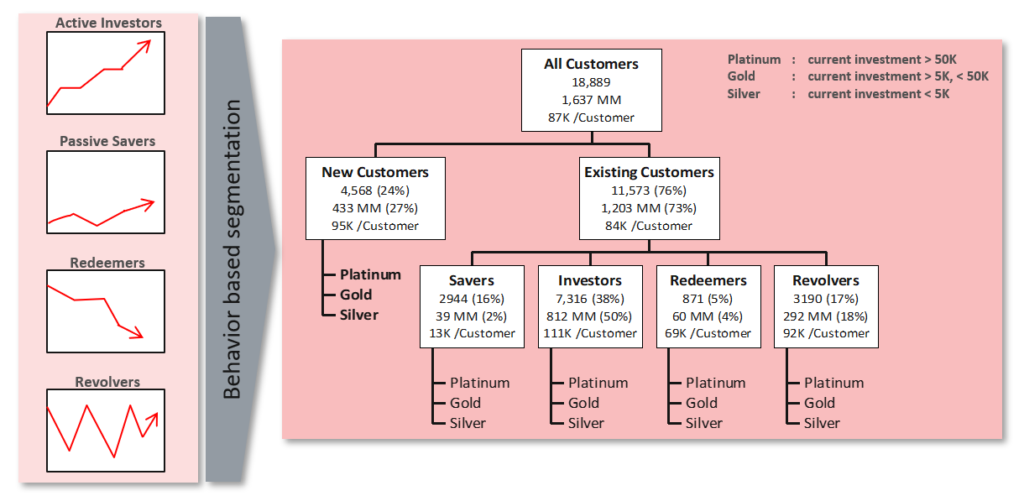

Behavioral Variables

Common variables: Product use or frequency, purchase behaviors, coupon use, retailer visits, lifestyle behaviors, hobbies.

Common variables: Product use or frequency, purchase behaviors, coupon use, retailer visits, lifestyle behaviors, hobbies.

Source of data: Transactional databases, loyalty databases, association membership lists, employee databases, website click-streams.

Behavioral data can be more expensive to acquire and, hence, this type of segmentation is less common. It focuses on how people behave, including what, when, and how they do it. That could mean which products they buy, whether they buy them in-store or online, or more personal behaviors such as how often they go to the movies or where they go on holidays.

As most researchers and marketers know, the best way to predict future behavior is by knowing past behavior. As a result, behavioral segmentation can be extremely effective.

.

Psychographic Variables

Psychographic Variables

Common variables: Lifestyle, opinions, attitudes, beliefs, values, interests, personality.

Source of data: Surveys, focus groups, interviews, online communities.

Unlike behavioral variables that tell you WHAT someone does, psychographic variables tell you WHY they do those things. This type of segmentation is generally the most difficult because it is difficult to see and difficult to action on.

Psychographic data help us understand why people make specific choices such as why they use coupons even though they can afford luxury brands, or why they don’t watch musicals at the theater even though they love watching musicals on TV.

.

Business Variables

Business Variables

Common variables: Industry, revenue, company size, job title, decision making powers.

Source of data: Surveys, third party data, data aggregators, census data, secondary research.

It’s important to remember that, not only can we segment people, we can also segment companies for B2B purposes. There may be far fewer companies but businesses still need to understand the segments of potential buyers that are more and less relevant for them to target.

.

What’s Next?

Are you ready to discover top quality insights about your buyers, brands, and business? Email your project specifications to our research experts using Projects at E2Eresearch dot com. We’d love to help you turn your enigmas into enlightenment!

.

Learn more from our case studies

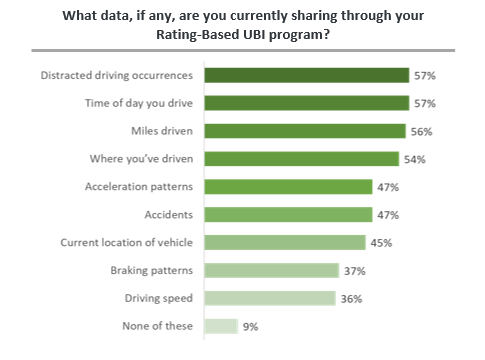

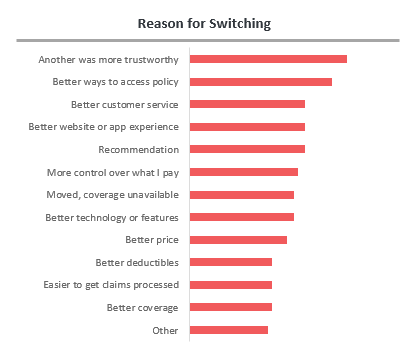

- Customer Behavioral Segmentation to Support Targeted Marketing – A BFSI data analytics case study

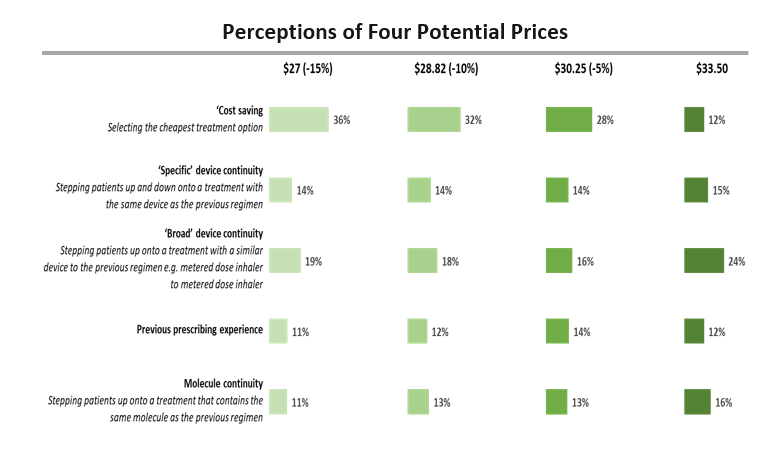

- Optimizing Treatment Pricing Strategies For Multiple Patient Segments – A pharmaceutical survey analytics case study

Learn more from our other blog posts

- How to Leverage TikTok as a Consumer and Customer Insights Tool

- 8 Engaging Question Types to Improve Participants’ Survey Taking Experience

- Everything You Need to Know about Conducting Effective Secondary Research

Tags

- New product development

- Customer segmentation

- Purchase intent

- Segmentation

- Market segmentation

- Behavioral segmentation

- Customer experience

- Market strategy

- Marketing message

- Decision journey

- Targeted marketing

- Customer profiles

- Consumer segmentation

- Psychographic segmentation

- Demographic segmentation