Ah, a rose by any other name smells just as sweet! Roses? Well, instead of using the phrase Usage and Attitude, you might hear some people use the phrase Habits and Practices. And instead of shortening it down to U&A, they’ll shorten it down to H&P. Whether you’re interested in a U&A or an H&P, we’re generally talking about the same thing. Use the acronym you prefer and we’ll all gain more valuable insights into consumer behavior, attitudes, and usage patterns.

What is a Usage and Attitude Study?

Usage and Attitudes studies aim to understand a broad range of behaviors and attitudes related to the people experiencing a product or service. It’s relevant for all products like food, beverages, hair care, and electronics, as well as services like healthcare, banking, and education.

Usage and Attitudes studies aim to understand a broad range of behaviors and attitudes related to the people experiencing a product or service. It’s relevant for all products like food, beverages, hair care, and electronics, as well as services like healthcare, banking, and education.

Most U&As gather information about the brand of interest, as well as competitive brands and the category as a whole. This ensures you gain a full understanding of any behaviors and attitudes that could eventually be relevant and important to the brand of interest.

Why is a Usage and Attitude Study Important?

U&As create a solid foundation for building a brand. They serve a number of important benefits in a variety of key areas.

People: Know your buyer and your consumer

- Create more relevant and memorable messaging by understanding the unique demographic and psychographic characteristics of each segment of users that has been identified in any segmentation research you’ve conducted

- Understand purchase drivers associated with each persona, e.g., price, availability, loyalty, packaging, sensory features, sustainability, durability

- Plan for the future by identifying what each segment needs and wants from an ideal product

- Differentiate between the needs of buyers (e.g., availability, pricing) and users (e.g., efficacy, sensation), and ensure the targeted message reaches each audience

Place: Know your buyers’ preferred information and purchase channels

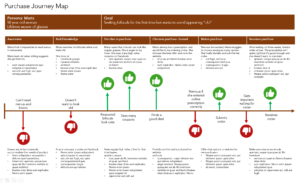

- Focus your marketing spend in the most effective channels by identifying the marketing and sales channels and influencers that are most effective and important at each stage of the purchase journey

Pricing: Know your buyers’ preferred pricing models

- Create the most effective pricing model by understanding attitudes towards various pricing strategies, e.g., every day low pricing vs sales vs bundling

Promotion: Know your buyers’ preferred promotion tactics

- Create the most effective promotion model by understanding which types of promotions are relevant for your buyers, e.g., in-store promotions, OOH promotions, door-to-door promotions

Product: Know what your consumer needs and wants from your product

- Prevent switching and abandonment by identifying and resolving frustrations, complaints, and pain points

- Encourage purchase by identifying and reminding people of desired benefits and advantages

- Plan product improvements by understanding which product features people love and hate

Strategy: Know how to position and plan for the future

- Plan for a more competitive long-term evolution of your brand and potential brand extensions by understanding the competitive space

- Predict the growth and avoidable decline of your brand by maintaining and tracking accurate norms as they relate to current culture and society

- Create a data-driven baseline that can be used to support strategic decisions unaffected by changes in leadership

- Forecast category and brand growth

What Questions to Ask in a Usage and Attitude Study

As with any research project, there is an unlimited number of questions that could be asked. The key is to identify the specific research objectives for the imminent research project and focus the questions there.

As with any research project, there is an unlimited number of questions that could be asked. The key is to identify the specific research objectives for the imminent research project and focus the questions there.

Then, select a set of engaging questions that will keep the entire questionnaire to less than 15 minutes long. Don’t try to do everything or the data quality will suffer.

Brand Metrics

- Awareness: When you think of this product category, which brands come to mind first?

- Aided Awareness: From this list of brands, which ones have you heard of?

- Discovery: How did you first hear about this brand?

- Trial: Which brands of this category have you ever tried?

- Trial: Why did you decide to try this brand?

- Consideration: When you think of this product category, which brands would you consider buying?

- Consideration: From this list of brands, which ones would you considering buying?

- Preference: When you think of this product category, which brand do you most prefer?

- Loyalty: If your preferred brand was not available in your usual store, what would you do?

- Perceptions: Which 5 of these words reflect your opinions about this brand?

- Perceptions: What 3 things do you like about this brand? What 3 things do you dislike about this brand?

- Perceptions: Which of these brands is most innovative? Fun? Likeable? Effective? Appealing? Different?

- Perceptions: What is your opinion about the effectiveness of this brand? Quality? Appearance? Texture? Taste? Scent? Sound? Durability? Sustainability?

- Perceptions: Overall, what is your opinion about this brand?

Product Usage

- In your household, which of these people use this category?

- In your household, who uses this category most often?

- Where in your home is this category used?

- At what time of day/week/month/year is this category used?

- How is this category used?

- What occasions is this category used for? Every day? Holidays? Religious days? Birthdays?

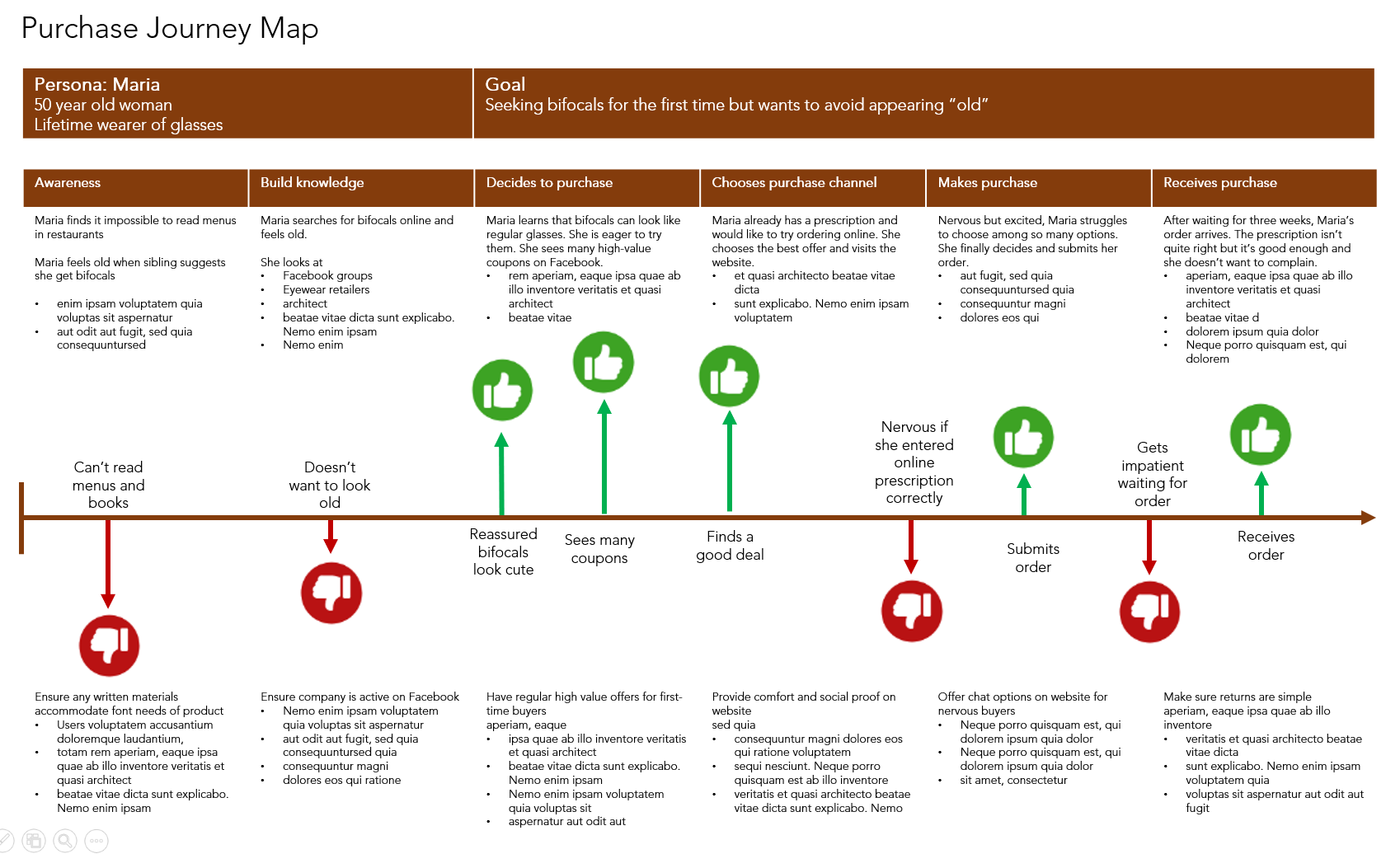

Purchase Journey:

Purchase Journey:

- Who usually buys the product?

- What are all the places where this category/brand is bought?

- Where is this category/brand usually bought?

- Where do you prefer to buy this category?

- On the next shopping trip, which brands will be bought?

Purchase Frequency / Recency / Monetary

- How often is each of these brands bought?

- How often is each of these brands used?

- In just the last 7 days, which of these brands have been bought?

- When was the last time each of these brands have been bought?

- What size package of category/brand is usually bought? What size is preferred?

- At what time of the day/week/month/year is this brand/category usually bought?

- The last time this category/brand was bought, about how much was spent on it?

- The last time this category/brand was bought, were any coupons or cost savings used?

- What is your opinion about using coupons? Buying at regular price? BOGOs?

Personal Details

- Demographics: Age, gender, income, education, ethnicity, religion, household size, children in home

- Psychographics: Personal attitudes towards relevant category characteristics, e.g., sustainability, early adoption, pricing preferences

Why Ask About Behaviors that Can Be Measured Digitally?

If time and money were no objectives, many metrics could be confirmed visually or digitally. Sometimes, however, it’s faster and easier to just ask people. Sometimes the data isn’t available in a properly formatted, readable database. Sometimes the data isn’t available for purchase. And sometimes, we need to match attitude data with behavior data for specific people.

If time and money were no objectives, many metrics could be confirmed visually or digitally. Sometimes, however, it’s faster and easier to just ask people. Sometimes the data isn’t available in a properly formatted, readable database. Sometimes the data isn’t available for purchase. And sometimes, we need to match attitude data with behavior data for specific people.

Or, and this is much more interesting, maybe we want to understand what people think they are doing. The way people think about or recall their behaviors is an indirect measure of awareness, loyalty, believability, and likeability. If people can’t remember which brand they buy, whether the name or the logo, that’s not a great indicator of brand loyalty which could permit a premium pricing strategy.

What’s Next?

Most brands are well served to conduct a U&A study. If you’re ready to discover top quality insights about your buyers, brands, and business, email your project specifications to our research experts using Projects at E2Eresearch dot com. We’d love to help you turn your enigmas into enlightenment!

Learn more from our case studies

- Customer Behavioral Segmentation to Support Targeted Marketing – A BFSI data analytics case study

- Increasing Enrollment Through A More Meaningful Brand Purpose – An education survey case study

- Modeling a Consumer Response Hierarchy to Guide Brand Strategy – A personal care survey analytics case study

- Understanding Patient Preferences to Inform Differentiation Strategy – A medical device patient survey case study

Learn more from our other blog posts

- Getting started with consumer, customer, and market segmentation

- 8 Engaging Question Types to Improve Participants’ Survey Taking Experience

- Journey Mapping from Enigma to Enlightenment: An E2E Research Webinar

- A Brand Manager’s Practical Guide to Brand Tracking

Nearly any journey wherein people progress through a set of stages, interacting with channels or people, over a short or long time frame to accomplish a goal can be mapped. Here are just a few of the more common journey maps that marketers and brand managers use.

Nearly any journey wherein people progress through a set of stages, interacting with channels or people, over a short or long time frame to accomplish a goal can be mapped. Here are just a few of the more common journey maps that marketers and brand managers use.

Well, we know that people don’t care about everything. They care about things that are particularly relevant to their situation – their demographics, their psychographics, their hobbies, their political views, their geographical location.

Well, we know that people don’t care about everything. They care about things that are particularly relevant to their situation – their demographics, their psychographics, their hobbies, their political views, their geographical location. There are many benefits of a market segmentation but what follows are a few key benefits. Segmentation allows you to:

There are many benefits of a market segmentation but what follows are a few key benefits. Segmentation allows you to: Consumers, customers, companies, and markets can be described in many different ways. However, without these four characteristics, a segmentation strategy is sure to fail. As you build your model, make sure it incorporates each of these four requirements.

Consumers, customers, companies, and markets can be described in many different ways. However, without these four characteristics, a segmentation strategy is sure to fail. As you build your model, make sure it incorporates each of these four requirements. Common variables: Age, gender, ethnicity, education, income, occupation, family size,

Common variables: Age, gender, ethnicity, education, income, occupation, family size,  Common variables: Region, country, state, city, neighborhood, zip.

Common variables: Region, country, state, city, neighborhood, zip. Common variables: Product use or frequency, purchase behaviors, coupon use, retailer visits, lifestyle behaviors, hobbies.

Common variables: Product use or frequency, purchase behaviors, coupon use, retailer visits, lifestyle behaviors, hobbies. Psychographic Variables

Psychographic Variables Business Variables

Business Variables

A lot of market research starts by truly understanding a specific audience. Who are they – what are their hobbies, where do they live, where do they work, what does their family look like? It’s really easy to calculate a median age and the percentage of customers who are female but the last few years have taught us a lot about intersectionality – it’s not just “women,” it’s “disabled Black women.” In the research world, we understand this as customer segments or personas.

A lot of market research starts by truly understanding a specific audience. Who are they – what are their hobbies, where do they live, where do they work, what does their family look like? It’s really easy to calculate a median age and the percentage of customers who are female but the last few years have taught us a lot about intersectionality – it’s not just “women,” it’s “disabled Black women.” In the research world, we understand this as customer segments or personas. If you’ve written a questionnaire before, you know how important this tip is. Sure, you could write a questionnaire as if you were Charles Dickens showing off his stunning, grammatically correct 200-word sentences with multiple, embedded clauses.

If you’ve written a questionnaire before, you know how important this tip is. Sure, you could write a questionnaire as if you were Charles Dickens showing off his stunning, grammatically correct 200-word sentences with multiple, embedded clauses. How do you get colleagues to share your research? Easy! Well, it’s not that easy. Storytelling is a necessary skill that will carry your research results throughout the company. Let people know what is exciting about the insights, how they could be used to reach consumers in unexpected ways, how they could personally benefit from understanding the results.

How do you get colleagues to share your research? Easy! Well, it’s not that easy. Storytelling is a necessary skill that will carry your research results throughout the company. Let people know what is exciting about the insights, how they could be used to reach consumers in unexpected ways, how they could personally benefit from understanding the results. You could build and execute a 5-year research plan.

You could build and execute a 5-year research plan.

Now that we’re in the business world, secondary research includes finding and analyzing:

Now that we’re in the business world, secondary research includes finding and analyzing: On the other hand, complex desk research might take weeks or months depending on how difficult it is find and analyze the information. For instance, developing a new product and introducing it to a new country with existing competitors would benefit from secondary research to address business problems such as:

On the other hand, complex desk research might take weeks or months depending on how difficult it is find and analyze the information. For instance, developing a new product and introducing it to a new country with existing competitors would benefit from secondary research to address business problems such as: Just because you aren’t designing a questionnaire or interview doesn’t mean you can get away without well defined research objectives. Build a clear plan with specific research questions. Identify the types of data that could answer those questions – census data? Interview data? Sales data? It’s okay to start the research process with random searching in random places just to get a sense of what you know and don’t know. But, once you’ve used up that allotted discovery time, be specific and detailed about your next steps.

Just because you aren’t designing a questionnaire or interview doesn’t mean you can get away without well defined research objectives. Build a clear plan with specific research questions. Identify the types of data that could answer those questions – census data? Interview data? Sales data? It’s okay to start the research process with random searching in random places just to get a sense of what you know and don’t know. But, once you’ve used up that allotted discovery time, be specific and detailed about your next steps.

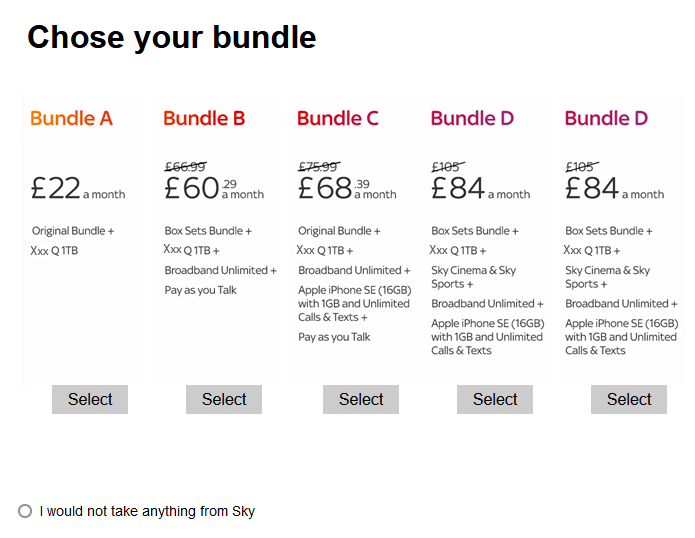

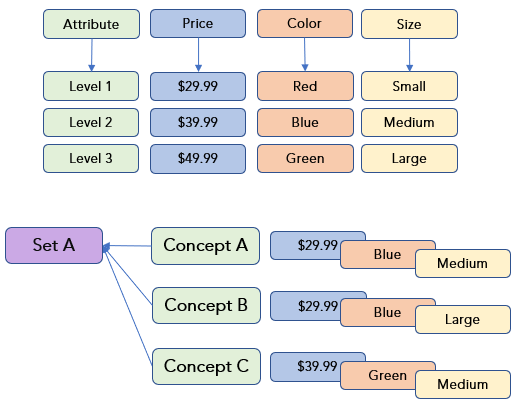

Include competitors: The real market includes competitors, often many. People don’t shop for single brands in isolation and neither should they answer your conjoint questions in isolation. Include at least one key competitor in your test, and preferably at least two. Further, if your brand is relatively unknown, you may wish to incorporate a competitor that is also relatively unknown.

Include competitors: The real market includes competitors, often many. People don’t shop for single brands in isolation and neither should they answer your conjoint questions in isolation. Include at least one key competitor in your test, and preferably at least two. Further, if your brand is relatively unknown, you may wish to incorporate a competitor that is also relatively unknown. Use imagery: We already know that a conjoint task can be cognitively demanding. That’s why imagery helps. Not only does it help people to visualize the product on the shelf amongst it’s competitive brands, it also helps to create a more visually appealing task (mmmmm cookies!). If you can’t provide an image of your product, find other ways to incorporate visuals in the questionnaire.

Use imagery: We already know that a conjoint task can be cognitively demanding. That’s why imagery helps. Not only does it help people to visualize the product on the shelf amongst it’s competitive brands, it also helps to create a more visually appealing task (mmmmm cookies!). If you can’t provide an image of your product, find other ways to incorporate visuals in the questionnaire.