Innovate or die.

I suspect many of us have heard that quote, usually attributed to Peter Drucker.

The goal of innovation is to create products or services that have original value, perhaps in response to changing industries or solving impeding social, health, or economic challenges. With an effective strategy for bringing about that innovation, your brand can achieve real change and growth. Without an innovation strategy, well, your brand could simply wither away and disappear.

Benefits of Innovation

Is it worth the financial burden to take time away from day-to-day production to focus on innovation? Given the following benefits, successful marketing and business leaders would say yes.

- Remain relevant. In a world that’s constantly evolving culturally, economically, and politically, innovation helps brands remain relevant to people of today, not ten or fifty years ago when the brand was first launched. For example, today, brands take care to understand that gender is a social construct, not a precise measurement that dictates women use pink razors and men use black razors. And, remaining relevant means we work to understand changing consumer perceptions towards online ordering, something that really picked up over the last three years.

- Develop new products. For creative minds, one of the key benefits of innovation is creating brand new products like pet food made from insect protein. Perhaps you’ve discovered a new pain point, audience segment, journey, or channel that warrants building a for-purpose product. Even better, starting from scratch means you can build in privacy, accessibility, sustainability, and many other core features right from the beginning rather than trying to hack them in at a later date.

- Improve your existing products. Innovation is not just about creating new products. It’s also about improving the efficacy of existing products and appealing to new target audiences with those existing products. Growth comes from creating a more valuable product for your existing customers, and new value for new customers.

- Optimize your costs. Innovation can also take place in systems and processes. New methods of building a product, delivering a service, or running operations can speed things up or make them less expensive. For example, we now have the option to use automated signature tools rather than physically mailing or even emailing business contracts.

Of course, all of these benefits contribute to the growth and expansion of the business with new or more desirable revenue streams.

Benefits of an Innovation Strategy

Innovating alone is insufficient to maintain growth. Creating an effective strategy to bring those innovations to life is essential for preparing for long-term unanticipated lows and desirable highs. There are other benefits as well.

- Align everyone to the same goals. Creating an innovation strategy helps ensure efforts in all departments and groups are in keeping with the mission and vision of your business. When everyone has the same understanding of how innovation fits into the business growth strategy, every department can aim for the same, overarching goals rather than pursuing unrelated and unfocused individual goals.

- Focus resources. When everyone is aligned to the same goals, company resources, whether financial, personnel, or otherwise will be used much more wisely. Less waste, less distraction, and more energy spent in the right places.

- No resting on laurels. It’s easy to recall the good old days when you accomplished that awesome ‘thing.’ But 5 years ago is ancient in today’s world. Hundreds of new products and companies have since been launched, all of which have the potential to knock your brand out of the top 10 or top 1000 spot. You need to keep on proving that you deserve to be in the top 10 spot or someone else will. Without a strategy to stay there…. you won’t.

What Does a Successful Innovation Strategy Look Like

Though every company has a unique innovation strategy, successful strategies share a number of key characteristics.

- Continuous rather than ad hoc. Rather than developing innovations in response to external events, successful strategies have a goal of continuous improvement. Time and funds for innovation are built into every process. It’s expected at every stage from every person.

- Calculated risks. Playing it safe is rarely a good attribute of successful strategies. Be prepared to take risks along the way. Stretch your ideas just out of bounds to see what could be. Iterate, test, repeat.

- Embrace failure. Successful innovation strategies embrace every small and large failure that inevitably happens along the way, recognizing that each one is a learning opportunity. Learn from each challenge and put processes into place to ensure those mistakes can’t happen again. Seek out and embrace criticisms and challenges. Caught early, resolving small challenges will prevent massive mistakes.

- Measure the efforts. Successful strategies keep count. Count the failures, the successes, the ideas, the launches. Set fair expectations for both contributors and the leadership team around those metrics so everyone can monitor growth.

- Create and stick to timelines. Create fair timelines and stick to them. Time spent on innovations that get repeatedly delayed and never become reality are a waste of everyone’s time.

- Get stakeholder buy-in. Rather than waiting until an innovation is ready to launch, successful innovation strategies get buy-in from the leadership team from day one to ensure those innovations are in keeping with the long-term goals of the company. Without early buy-in and ongoing progress reports, those efforts could be completely wasted.

What’s Next?

Are you ready to get creative and put innovation at the top of your strategic plan? Our expert team is ready to help you gain new insights about your buyers, brands, and business that will support your next big innovation! Email your project specifications to our research experts using Projects at E2Eresearch dot com. We’d love to help you turn your enigmas into enlightenment!

Podcasts You Might Like

- How I Built This with Guy Raz

- Women in Innovation podcast

- What is Innovation with Jared Simmons

- Moonshoots Podcast: Learning Out Loud with Mike Parsons & Mark Pearson Freeland

Books You Might Like

- The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail by Clayton M. Christenson

- 101 Design Methods: A Structured Approach for Driving Innovation in Your Organization by Vijay Kumar

- Ten Types of Innovation: The Discipline of Building Breakthroughs by Larry Keeley, Helen Walters, and Ryan Pikkel.

Learn more from our case studies

- Identifying An Optimal Set of Flavor Variants to Achieve Incremental Reach | case study

- Increasing Customer Acceptance For Controversial Pet Food Format – A survey case study

- Monitoring Blockchain Adoption Over Time | A survey case study

- Stretching Brand Equity into White Spaces Using Data Fusion – A pharmaceutical data analytics case study

Usage and Attitudes studies aim to understand a broad range of behaviors and attitudes related to the people experiencing a product or service. It’s relevant for all products like food, beverages, hair care, and electronics, as well as services like healthcare, banking, and education.

Usage and Attitudes studies aim to understand a broad range of behaviors and attitudes related to the people experiencing a product or service. It’s relevant for all products like food, beverages, hair care, and electronics, as well as services like healthcare, banking, and education.

As with any research project, there is an unlimited number of questions that could be asked. The key is to identify the specific research objectives for the imminent research project and focus the questions there.

As with any research project, there is an unlimited number of questions that could be asked. The key is to identify the specific research objectives for the imminent research project and focus the questions there.  Purchase Journey:

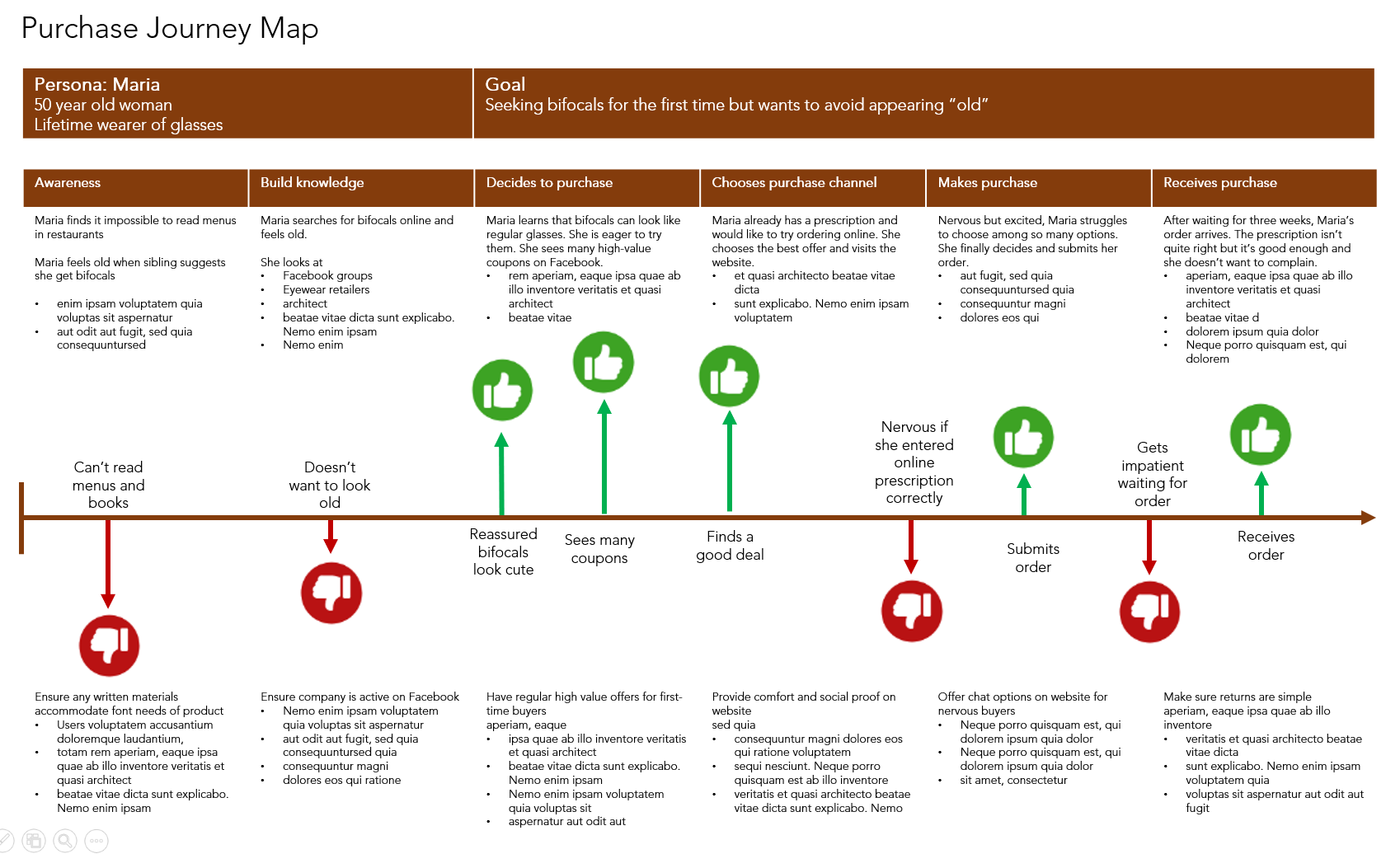

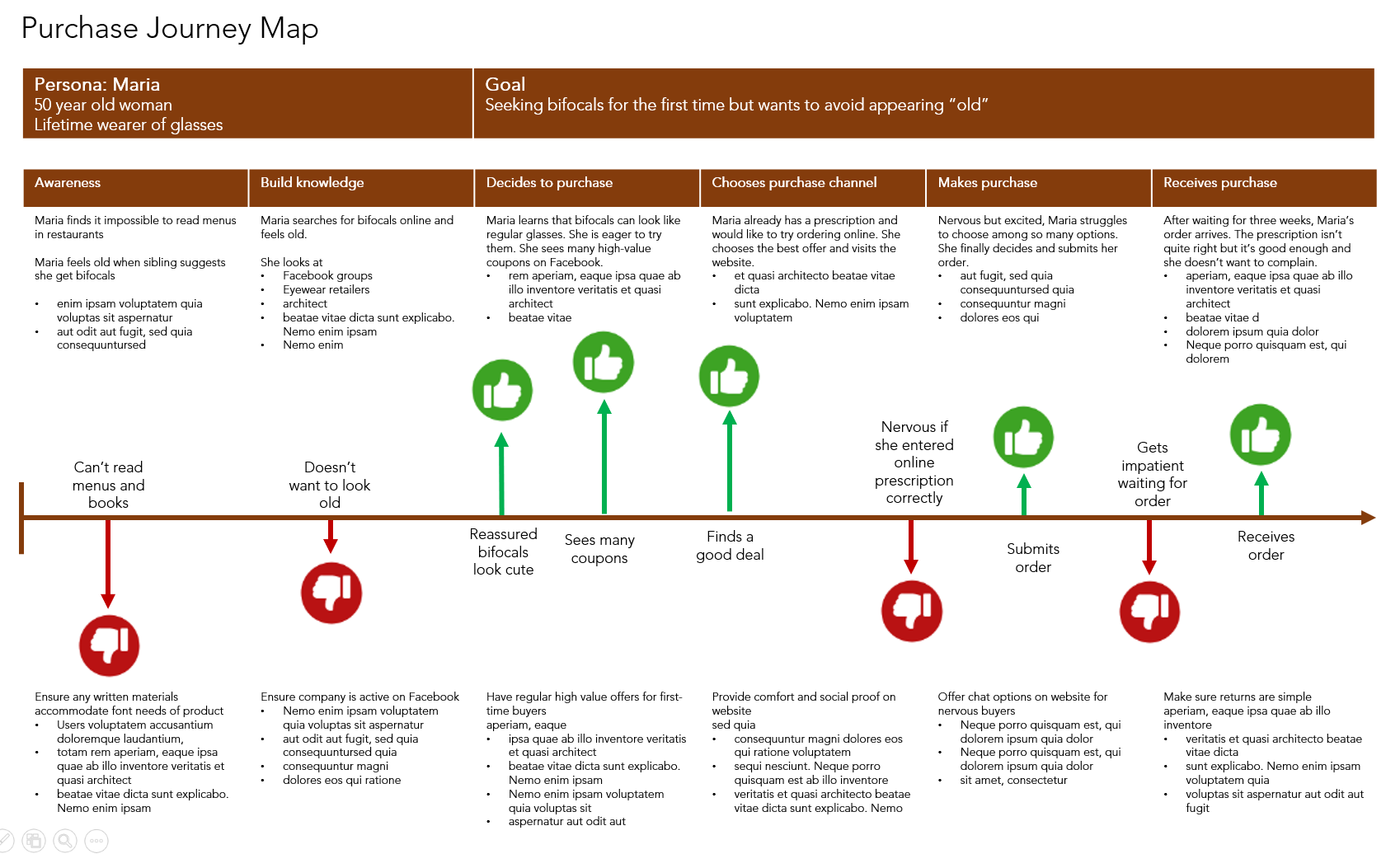

Purchase Journey: If time and money were no objectives, many metrics could be confirmed visually or digitally. Sometimes, however, it’s faster and easier to just ask people. Sometimes the data isn’t available in a properly formatted, readable database. Sometimes the data isn’t available for purchase. And sometimes, we need to match attitude data with behavior data for specific people.

If time and money were no objectives, many metrics could be confirmed visually or digitally. Sometimes, however, it’s faster and easier to just ask people. Sometimes the data isn’t available in a properly formatted, readable database. Sometimes the data isn’t available for purchase. And sometimes, we need to match attitude data with behavior data for specific people.

Amazon: Since starting up as a book seller, Amazon’s focused effort on meeting customer needs has resulted in amazing brand equity. Because of their unquestioning return policies, unending selection, and ability to get product in hand in mere hours, customers are fiercely loyal. That’s positive brand equity.

Amazon: Since starting up as a book seller, Amazon’s focused effort on meeting customer needs has resulted in amazing brand equity. Because of their unquestioning return policies, unending selection, and ability to get product in hand in mere hours, customers are fiercely loyal. That’s positive brand equity. Apple: Apple is another great example of a company with positive brand equity. Their customers are massively loyal. Even though Apple products are known to be pricey, customers line up every time a new product is released even if their existing product still works great. Customers trust the quality, reliability, and functionality of Apple products and remain loyal customers for years. Why? Because Apple focuses on creating innovative, self-explanatory products that meet customer needs every single time.

Apple: Apple is another great example of a company with positive brand equity. Their customers are massively loyal. Even though Apple products are known to be pricey, customers line up every time a new product is released even if their existing product still works great. Customers trust the quality, reliability, and functionality of Apple products and remain loyal customers for years. Why? Because Apple focuses on creating innovative, self-explanatory products that meet customer needs every single time. Chipotle: In 2015, Chipotle experienced a food poisoning crisis which led to a $25 million federal fine. After years of positive growth, that crisis caused the brand value to decline sharply. It was several years before they managed to regain consumer trust, and recover and grow their brand value. This is a great example of positive brand equity turned negative and then reverting to positive again.

Chipotle: In 2015, Chipotle experienced a food poisoning crisis which led to a $25 million federal fine. After years of positive growth, that crisis caused the brand value to decline sharply. It was several years before they managed to regain consumer trust, and recover and grow their brand value. This is a great example of positive brand equity turned negative and then reverting to positive again. McDonald’s: Though McDonald’s has been the #1 burger chain for years, they struggle with ongoing negative brand equity. Customers and consumers have complained about unhealthy food options for decades, and that perception seems relenting no matter how McDonald’s tries to head it off.

McDonald’s: Though McDonald’s has been the #1 burger chain for years, they struggle with ongoing negative brand equity. Customers and consumers have complained about unhealthy food options for decades, and that perception seems relenting no matter how McDonald’s tries to head it off. Starbucks: Want some high-priced coffee? Well, Starbucks customers are willing to pay a premium because they love the high-quality product and they love the top-notch customer experience – even when their name is accidentally (deliberately?) misspelled on their cup. Whether you’re a customer or not, everyone immediately recognizes the logo of this high equity brand.

Starbucks: Want some high-priced coffee? Well, Starbucks customers are willing to pay a premium because they love the high-quality product and they love the top-notch customer experience – even when their name is accidentally (deliberately?) misspelled on their cup. Whether you’re a customer or not, everyone immediately recognizes the logo of this high equity brand. Toms: People love the Toms shoe company. Why? Not only do they make a great shoe, they donate a pair of shoes with every purchase. This human centered value makes customers feel good about their purchases, and keeps them coming back again and again to support a company that matches their own values.

Toms: People love the Toms shoe company. Why? Not only do they make a great shoe, they donate a pair of shoes with every purchase. This human centered value makes customers feel good about their purchases, and keeps them coming back again and again to support a company that matches their own values.

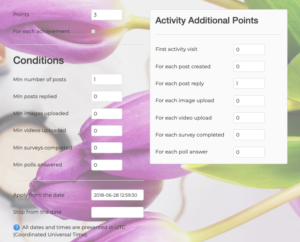

Like any market or consumer research project that intends to generalize valid and reliable findings to a broader population, every insight community needs clear planning, goals, and research objectives that lead to specific outcomes. “Signing up” or “finding lots of members” are not acceptable goals, nor is “getting lots of comments every day.”

Like any market or consumer research project that intends to generalize valid and reliable findings to a broader population, every insight community needs clear planning, goals, and research objectives that lead to specific outcomes. “Signing up” or “finding lots of members” are not acceptable goals, nor is “getting lots of comments every day.”  From focus groups to questionnaires, researchers have many data collection tools to choose from, each with their own benefits. However, insight communities that allow people to log in and out at their own convenience have many benefits for participants. They:

From focus groups to questionnaires, researchers have many data collection tools to choose from, each with their own benefits. However, insight communities that allow people to log in and out at their own convenience have many benefits for participants. They: Communities aren’t a quick alternative to groups or interviews. Even if a community is planned to run over just a couple of days, it requires extensive pre-planning, moderation during those days, and lots of post-project analysis and identification of next steps. Without planning for this investment of time and resources, everyone’s efforts will be lost.

Communities aren’t a quick alternative to groups or interviews. Even if a community is planned to run over just a couple of days, it requires extensive pre-planning, moderation during those days, and lots of post-project analysis and identification of next steps. Without planning for this investment of time and resources, everyone’s efforts will be lost. Insight communities also have clear rules for participants who wish to join and remain part of the community. They may include requirements to:

Insight communities also have clear rules for participants who wish to join and remain part of the community. They may include requirements to: Insight communities can take many forms. Sometimes, they’re just a few days long and focus on one or two specific products. Other times, they can last several months and focus on broad categories.

Insight communities can take many forms. Sometimes, they’re just a few days long and focus on one or two specific products. Other times, they can last several months and focus on broad categories. Online communities help lower costs in different ways. First, longer-term communities can take the place of multiple ad-hoc projects. This eliminates the need to recruit participants multiple times. Further, participants are already ‘trained’ in how research works and need far less time and guidance to navigate the software and complete the tasks.

Online communities help lower costs in different ways. First, longer-term communities can take the place of multiple ad-hoc projects. This eliminates the need to recruit participants multiple times. Further, participants are already ‘trained’ in how research works and need far less time and guidance to navigate the software and complete the tasks.