Are you launching a start-up? Then I bet you have hundreds of questions about your potential product and your target audience.

From conceptualization to market sizing and scaling, innumerable questions must be answered in order to build a solid foundation for a successful business. Fortunately, a full range of qualitative and quantitative research, primary and secondary research, and data analytics solutions exist to help you discover actionable answers to those questions throughout the entire process.

During the initial conceptualization stage, you’ll need to gain a comprehensive and unbiased understanding of the problem and potential solutions. You’ll also need to understand the tangents, side-conversations, and unspoken truths and myths that people won’t necessarily share with just anyone. To gain these types of insights from your target audience, qualitative research will be your go-to method.

Numerous qualitative techniques can help you at this point so let’s start by learning about in-depth, individual interviews.

What are individual interviews?

As the name suggests, individual interviews are in-depth conversations between a trained moderator and one other person. If the product or service is specifically designed for 2 or 3 people to use together, dyads or triads with colleagues, best friends, children, partners, or spouses may be used as well.

As the name suggests, individual interviews are in-depth conversations between a trained moderator and one other person. If the product or service is specifically designed for 2 or 3 people to use together, dyads or triads with colleagues, best friends, children, partners, or spouses may be used as well.

Key to this technique is working with a trained moderator. Although everyone has experience chatting with consumers, customers, or clients on a one to one basis, a research interview is completely different from a “chat” or “conversation.”

Trained moderators have unique skills which include understanding and responding to the body language of the person they’re interviewing. They have learned how and when to use specific language to encourage someone to share more detailed and personal insights. And, most importantly, they actively strive to prevent bias from unconsciously creeping into a conversation.

Interviews are an excellent way to deeply connect with your target audience and get a first-hand look into their emotional and physical real world. Interviews will allow you to:

- Spend meaningful time with them such that they open up about their personal habits, behaviors, needs, drivers, emotions, and opinions.

- Watch and listen to them struggle using unsuitable, existing products and services in their real world, whether that’s in their home, school, office, or gym.

- Watch and listen to them as they attempt to shop for alternative products using both online and offline channels.

These observations will guide you towards a thorough and unbiased understanding of what the problems and required solutions really are.

What follows are key questions that an interviewer might address during the initial, conceptualization stage.

How are people emotionally connected to the problem?

- How do you feel about this situation? What types of emotions do you have dealing with this situation? How strong are those emotions?

- How does this situation interact with different aspects of your life – at home, at work, with your kids or parents?

- How do you feel about the available alternatives or lack of alternatives? How do you compensate for the lack of easily accessible alternatives?

- What is your emotional state when you really need an alternative and can’t find one?

- How do your personal finances and resources fit into finding alternatives?

Who are the primary and secondary stakeholders?

- Who uses or needs the product? Who else might use it if they saw it lying around? Who would do the shopping for it? Who would approve and pay for it? Who would ensure the product gets used? Who would help you use the product and how would they help you use it?

- What frustrations and pain points do you have during the situation? What are the pain points of people who must find alternative options and pay for alternatives for you?

- Who is negatively and positively affected by this situation being unresolved?

What alternative solutions are being used now?

- What compromises do you make regarding this situation?

- What do you wish you could do? How would you solve the situation?

- How do you find and learn about potential alternatives?

- How do you physically manipulate or use current products? What other items do you use the product with? What do you buy to support using the current product?

- Where do you use current and alternative products? How do you use them?

- Where do you store current products and packages? What are your fears about storing them?

What’s Next?

During the conceptualization stage, your main goal is to listen and understand the problem without bias. You need to truly hear people and learn about their personal experiences so that you can identify both major and minor problems that may need to be solved. Individual interviews are the perfect solution for understanding people’s most intimate perceptions and behaviors. You’ll build a broad and deep baseline for what the key problems are and the range of major and minor issues that need to be resolved.

If you’re ready to deeply understand your target audience with individual interviews, please get in touch with us. We’d love to help you grow your start-up into a successful business! Email your questions about gathering information to support your startup to our research experts using Projects at E2Eresearch dot com.

Learn more from our case studies

- Building a Strategic Business Plan Grounded in Industry Data – A pharmaceutical data analytics case study

- Creating a Beverage Launch Strategy in a Competitive Market – A beverage desk research case study

- Developing a New Nutritional Pasta Product – A survey + desk research case study

- Identifying Optimum Price Corridors to Predict Volume Share – An advertising price simulator case study

Podcasts You Might Like

- Masters of Scale with Reid Hoffman

- The Tim Ferriss Show

- Business Wars with David Brown

- How I Built This with Guy Raz

Books You Might Like

- What It Takes: How I Built a $100 Million Business Against the Odds Hardcover by Raegan Moya-Jones

- The Entrepreneur Roller Coaster: It’s Your Turn to #Jointheride Hardcover by Darren Hardy

- What I Wish I Knew When I Was 20 – 10th Anniversary Edition: A Crash Course on Making Your Place in the World by Tina Seelig

Conferences You Might Like

- CES Consumer Technology Association (January)

- AWE (June)

- Collision Conference (June)

- The Startup Conference (May)

- SaaStr Annual (September)

Amazon: Since starting up as a book seller, Amazon’s focused effort on meeting customer needs has resulted in amazing brand equity. Because of their unquestioning return policies, unending selection, and ability to get product in hand in mere hours, customers are fiercely loyal. That’s positive brand equity.

Amazon: Since starting up as a book seller, Amazon’s focused effort on meeting customer needs has resulted in amazing brand equity. Because of their unquestioning return policies, unending selection, and ability to get product in hand in mere hours, customers are fiercely loyal. That’s positive brand equity. Apple: Apple is another great example of a company with positive brand equity. Their customers are massively loyal. Even though Apple products are known to be pricey, customers line up every time a new product is released even if their existing product still works great. Customers trust the quality, reliability, and functionality of Apple products and remain loyal customers for years. Why? Because Apple focuses on creating innovative, self-explanatory products that meet customer needs every single time.

Apple: Apple is another great example of a company with positive brand equity. Their customers are massively loyal. Even though Apple products are known to be pricey, customers line up every time a new product is released even if their existing product still works great. Customers trust the quality, reliability, and functionality of Apple products and remain loyal customers for years. Why? Because Apple focuses on creating innovative, self-explanatory products that meet customer needs every single time. Chipotle: In 2015, Chipotle experienced a food poisoning crisis which led to a $25 million federal fine. After years of positive growth, that crisis caused the brand value to decline sharply. It was several years before they managed to regain consumer trust, and recover and grow their brand value. This is a great example of positive brand equity turned negative and then reverting to positive again.

Chipotle: In 2015, Chipotle experienced a food poisoning crisis which led to a $25 million federal fine. After years of positive growth, that crisis caused the brand value to decline sharply. It was several years before they managed to regain consumer trust, and recover and grow their brand value. This is a great example of positive brand equity turned negative and then reverting to positive again. McDonald’s: Though McDonald’s has been the #1 burger chain for years, they struggle with ongoing negative brand equity. Customers and consumers have complained about unhealthy food options for decades, and that perception seems relenting no matter how McDonald’s tries to head it off.

McDonald’s: Though McDonald’s has been the #1 burger chain for years, they struggle with ongoing negative brand equity. Customers and consumers have complained about unhealthy food options for decades, and that perception seems relenting no matter how McDonald’s tries to head it off. Starbucks: Want some high-priced coffee? Well, Starbucks customers are willing to pay a premium because they love the high-quality product and they love the top-notch customer experience – even when their name is accidentally (deliberately?) misspelled on their cup. Whether you’re a customer or not, everyone immediately recognizes the logo of this high equity brand.

Starbucks: Want some high-priced coffee? Well, Starbucks customers are willing to pay a premium because they love the high-quality product and they love the top-notch customer experience – even when their name is accidentally (deliberately?) misspelled on their cup. Whether you’re a customer or not, everyone immediately recognizes the logo of this high equity brand. Toms: People love the Toms shoe company. Why? Not only do they make a great shoe, they donate a pair of shoes with every purchase. This human centered value makes customers feel good about their purchases, and keeps them coming back again and again to support a company that matches their own values.

Toms: People love the Toms shoe company. Why? Not only do they make a great shoe, they donate a pair of shoes with every purchase. This human centered value makes customers feel good about their purchases, and keeps them coming back again and again to support a company that matches their own values.

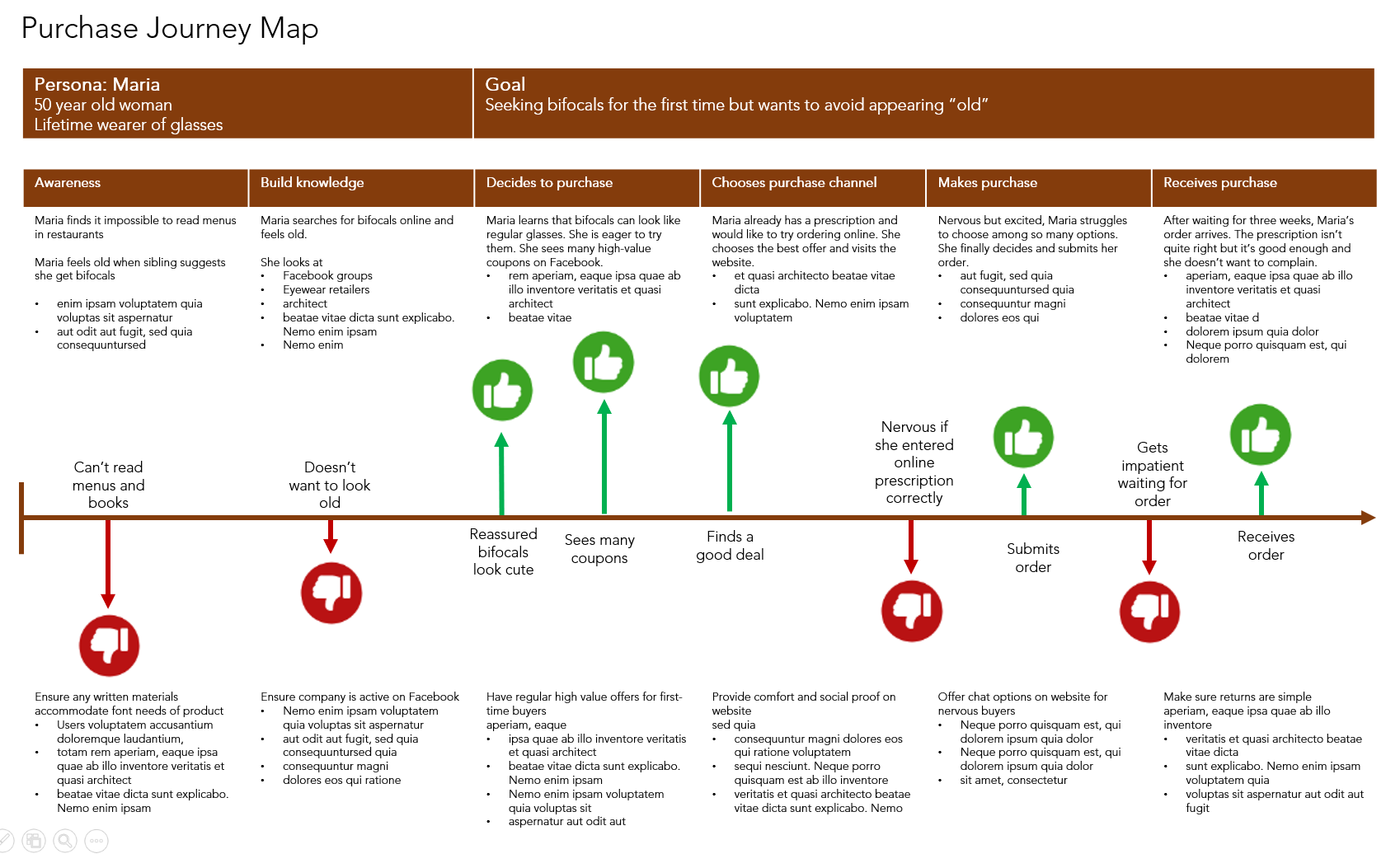

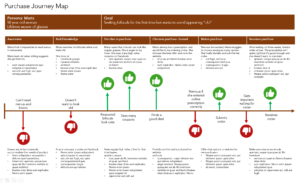

Nearly any journey wherein people progress through a set of stages, interacting with channels or people, over a short or long time frame to accomplish a goal can be mapped. Here are just a few of the more common journey maps that marketers and brand managers use.

Nearly any journey wherein people progress through a set of stages, interacting with channels or people, over a short or long time frame to accomplish a goal can be mapped. Here are just a few of the more common journey maps that marketers and brand managers use.

A lot of market research starts by truly understanding a specific audience. Who are they – what are their hobbies, where do they live, where do they work, what does their family look like? It’s really easy to calculate a median age and the percentage of customers who are female but the last few years have taught us a lot about intersectionality – it’s not just “women,” it’s “disabled Black women.” In the research world, we understand this as customer segments or personas.

A lot of market research starts by truly understanding a specific audience. Who are they – what are their hobbies, where do they live, where do they work, what does their family look like? It’s really easy to calculate a median age and the percentage of customers who are female but the last few years have taught us a lot about intersectionality – it’s not just “women,” it’s “disabled Black women.” In the research world, we understand this as customer segments or personas. If you’ve written a questionnaire before, you know how important this tip is. Sure, you could write a questionnaire as if you were Charles Dickens showing off his stunning, grammatically correct 200-word sentences with multiple, embedded clauses.

If you’ve written a questionnaire before, you know how important this tip is. Sure, you could write a questionnaire as if you were Charles Dickens showing off his stunning, grammatically correct 200-word sentences with multiple, embedded clauses. How do you get colleagues to share your research? Easy! Well, it’s not that easy. Storytelling is a necessary skill that will carry your research results throughout the company. Let people know what is exciting about the insights, how they could be used to reach consumers in unexpected ways, how they could personally benefit from understanding the results.

How do you get colleagues to share your research? Easy! Well, it’s not that easy. Storytelling is a necessary skill that will carry your research results throughout the company. Let people know what is exciting about the insights, how they could be used to reach consumers in unexpected ways, how they could personally benefit from understanding the results. You could build and execute a 5-year research plan.

You could build and execute a 5-year research plan.