What is brand equity?

Think about a brand you absolutely love – a store you can never wait to go to, a product that makes you grin just thinking about it.

Now think about brands you absolutely hate – a product or company that makes millions of people roll their eyes and groan with disgust.

That’s brand equity! Or lack thereof.

Brand equity is a complex construct. At its core, it’s a subjective perception of a brand’s value, quality, performance, and personal relevance. It incorporates consumer perceptions related to the product and its packaging, presentation, mission, vision, and values.

An easy way to think about brand equity is that it’s the difference in price and preference between an unbranded (or store brand) product and a branded product. Even though they’re the exact same thing – soda, butter, oil, beef, corn, eggs, many people will choose the brand name version because of the higher value they perceive it to have.

It can take a long time to build brand equity but one wrong move and it can be destroyed in seconds.

Why is brand equity important?

There are many benefits to building brand equity, and collectively their benefits are massive.

- Premium pricing: One of the key benefits of high brand equity is the ability to charge premium pricing. When people believe in and love a brand, they will pay more for it. Coffee is coffee but people will pay more for coffee that comes in a cup with a Starbucks brand on it, a name they know and trust. That higher price leads to higher profits which, of course, leads to greater financial success.

- Low price elasticity: When people value a brand, they are more likely to purchase that brand even in competitive situations. High equity brands don’t have to worry as much that competitive brands will ‘steal’ their customers with a great BOGO or intriguing offer. And, they don’t have to spend as much time and money creating offers to convince competitive buyers to try their products.

- Customer lifetime value: When brands create high equity, their customers are more loyal to the brand and purchase more of their products over a longer time period. Even better, those loyal customers are more likely to try new products created by the brand, whether in the same or other categories. The trust has already been built and customers don’t have to overcome the fear of trying a new brand. They simply need to determine whether the new product meets their needs.

- Market resilience: Products with high brand equity are more likely to endure during uncertain circumstances. When environmental, social, and political events necessitate a change in purchase and behavioural patterns, people will still try to retain consistency in their lives. High equity brands offer consistency, trust, and reliability when consumers need it most.

- Market power: As a high equity brand that people trust and desire, you have increased opportunities to attract and demand the best. Your demonstrated power in the marketplace means you can attract the best employees, the best suppliers, the best investors, and also negotiate the best prices and rates.

How to Build Brand Equity?

Brand equity can take a long time to build. However, there are a number of strategies and tactics that companies can leverage to get there. The key is playing the long game.

- Understand consumer needs and values: By understanding what consumers truly want and need, you can ensure your products and services are relevant to them. Take advantage of quantitative questionnaires and qualitative focus groups and interviews to understand customer journeys, gaps and pain points, customer personas, and customer segments. Dig deep to uncover their physical, emotional, social, psychological, environmental, and spiritual needs so that you can discover what might convert them from casual tryers to long-term, loyal advocates.

- Understand product differentiators: Not only do you need to understand your buyers and prospects, you need to understand what attributes elevate your products and services ahead of your competitors. Primary and secondary research will help you understand the competitive marketplace, market positioning, innovation opportunities, or opportunities for product optimization.

- Fine-tune your messaging: Once you understand your consumers and your products, ensure your messaging is in alignment. Primary research will help you ensure your product messaging and campaign research focus on messages that resonate with your customers and address their key values, unmet needs, values, and pain points.

- Deliver on promises: It may sound easy, but delivering on your brand promise is tough. Most brands have many disparate channels, all of which need to present your brand and your products in an unrelentingly consistent way. Whether in-store, on the phone, or online, your brand’s character, values, and vision must drive every customer interaction and business decision in a consistent way.

- Foster loyalty: It’s important to foster loyalty among your existing customers. Pay attention to your most loyal customers and create opportunities to reward and encourage them. Give them reasons to continue loving your brand whether that’s special offers or enhanced customer service.

- Drive awareness: If you’ve been paying attention to the animated image to the right, you’ve probably been able to name the brand behind every single logo. Despite the fact that not a single brand name is shown. This is brand equity. And this is the level of brand awareness that every brand ultimately strives for. When your customers and prospects recognize your brand colors and shapes, it’s far easier for them to find and choose your brand off the shelf, virtual or physical. Run carefully targeted advertising campaigns on a variety of relevant channels that focus on your benefits, stories, and value to help consumers learn, and connect your messages and your branding. Try a variety of relevant tactics such as influencer marketing, celebrity endorsements, or event marketing.

- Create positive customer relationships: Customer experiences are no longer confined to the physical store. Brands need to create positive experience across every physical and digital touchpoint including their own online stores and social media channels like Twitter, Instagram, and TikTok. Pay attention and respond quickly to customers sharing their opinions on review websites like Amazon, Foursquare, and Yelp.

Positive brand equity vs. negative brand equity

When people pay more for a brand even when there are equivalent yet lower priced brands available, that’s positive brand equity.

But, when people avoid or ignore a brand, even when it’s pricing is very competitive, that’s negative brand equity. For some companies, negative brand equity can destroy a brand such that consumers quickly forget it ever existed. For others, the negative equity is fleeting and at least somewhat recoverable.

Amazon: Since starting up as a book seller, Amazon’s focused effort on meeting customer needs has resulted in amazing brand equity. Because of their unquestioning return policies, unending selection, and ability to get product in hand in mere hours, customers are fiercely loyal. That’s positive brand equity.

Amazon: Since starting up as a book seller, Amazon’s focused effort on meeting customer needs has resulted in amazing brand equity. Because of their unquestioning return policies, unending selection, and ability to get product in hand in mere hours, customers are fiercely loyal. That’s positive brand equity.

Apple: Apple is another great example of a company with positive brand equity. Their customers are massively loyal. Even though Apple products are known to be pricey, customers line up every time a new product is released even if their existing product still works great. Customers trust the quality, reliability, and functionality of Apple products and remain loyal customers for years. Why? Because Apple focuses on creating innovative, self-explanatory products that meet customer needs every single time.

Apple: Apple is another great example of a company with positive brand equity. Their customers are massively loyal. Even though Apple products are known to be pricey, customers line up every time a new product is released even if their existing product still works great. Customers trust the quality, reliability, and functionality of Apple products and remain loyal customers for years. Why? Because Apple focuses on creating innovative, self-explanatory products that meet customer needs every single time.

Chipotle: In 2015, Chipotle experienced a food poisoning crisis which led to a $25 million federal fine. After years of positive growth, that crisis caused the brand value to decline sharply. It was several years before they managed to regain consumer trust, and recover and grow their brand value. This is a great example of positive brand equity turned negative and then reverting to positive again.

Chipotle: In 2015, Chipotle experienced a food poisoning crisis which led to a $25 million federal fine. After years of positive growth, that crisis caused the brand value to decline sharply. It was several years before they managed to regain consumer trust, and recover and grow their brand value. This is a great example of positive brand equity turned negative and then reverting to positive again.

McDonald’s: Though McDonald’s has been the #1 burger chain for years, they struggle with ongoing negative brand equity. Customers and consumers have complained about unhealthy food options for decades, and that perception seems relenting no matter how McDonald’s tries to head it off.

McDonald’s: Though McDonald’s has been the #1 burger chain for years, they struggle with ongoing negative brand equity. Customers and consumers have complained about unhealthy food options for decades, and that perception seems relenting no matter how McDonald’s tries to head it off.

Starbucks: Want some high-priced coffee? Well, Starbucks customers are willing to pay a premium because they love the high-quality product and they love the top-notch customer experience – even when their name is accidentally (deliberately?) misspelled on their cup. Whether you’re a customer or not, everyone immediately recognizes the logo of this high equity brand.

Starbucks: Want some high-priced coffee? Well, Starbucks customers are willing to pay a premium because they love the high-quality product and they love the top-notch customer experience – even when their name is accidentally (deliberately?) misspelled on their cup. Whether you’re a customer or not, everyone immediately recognizes the logo of this high equity brand.

Toms: People love the Toms shoe company. Why? Not only do they make a great shoe, they donate a pair of shoes with every purchase. This human centered value makes customers feel good about their purchases, and keeps them coming back again and again to support a company that matches their own values.

Toms: People love the Toms shoe company. Why? Not only do they make a great shoe, they donate a pair of shoes with every purchase. This human centered value makes customers feel good about their purchases, and keeps them coming back again and again to support a company that matches their own values.

How to Measure Brand Equity

Because brand equity is so multi-faceted, measuring it isn’t simple nor templated. It’s important to incorporate a range of relevant quantitative and qualitative metrics, as well as financial and market assessments to gain a holistic view of brand equity.

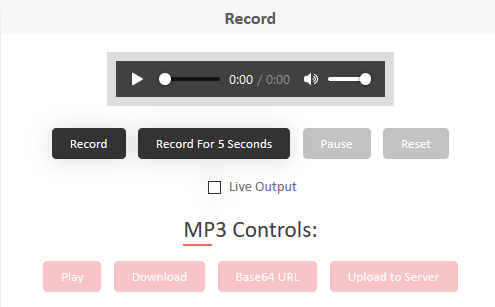

Quantitative metrics: As part of a quantitative questionnaires, there is a wide range of questions that can be posed to consumers and customers to better understand your brand equity. As you’ll seen in the images below, these kinds of questions can be posed not simply as traditional radio buttons and checkboxes, but also as interactive, engaging image style questions.

- Brand awareness: What three brands come to mind first when you think of washing detergent? What other brands have you heard of?

- Brand perception: Which of the following words reflect how you feel about this brand of washing detergent?

- Consideration: On a scale from 1 to 10, how likely are you to buy the following brands of washing detergent the next time you go shopping?

- Loyalty: On a scale from 1 to 10, how likely are you to recommend the following brands of washing detergent to your friends or family?

- Loyalty: How often do you buy the following brands of washing detergent?

- Trial: If this brand of washing detergent were to release a fabric softener, how likely are you to try it?

- Customer experience: On a scale from 1 to 10, what is your opinion about the customer service you received from our online chatbot or our social media or telephone representative?

.

.

Qualitative metrics: Of course, there is far more to measuring brand equity than focusing on quantitative questions. Focus groups, interviews, and other qualitative tools like online communities are also excellent ways to measure brand equity. By combining qual and quant methods, you can gain a more holistic view of this subjective construct. Here is a sample of some types of questions and tasks to incorporate in qualitative research, again with a couple examples of how more qualitative questions can be incorporated into traditional online measurements.

- What is your opinion of this logo and imagery?

- Describe 3 things you love about this brand and 3 things you hate about this brand.

- Why do you buy the following brands of washing detergent?

- Why would you choose one brand of washing detergent over another?

- Which of the following images reflect how you feel about this brand of washing detergent? Tell me why.

- If this brand of washing detergent was a person, how would you describe it?

Behavioral/transactional metrics: Financial and company metrics are also extremely important for understanding brand equity.

- Company metrics: What is the value of the company, and is it increasing?

- Brand metrics: What is the market share of the brand, and is it increasing? What is the profit of the brand, and is it increasing? What is the price difference compared to generic brands, and is it increasing? What is the purchase volume and frequency for the brand, and is it increasing?

- Employee metrics: What is the cost of employee acquisition, and is it decreasing? What is the average tenure of an employee, and is it increasing? How many applications per open position are received, and is it increasing?

- Customer metrics: What is the cost of customer acquisition, and is it decreasing? What is the average tenure of a customer, and is it increasing? How many customer complaints are receiving during a specific time frame, and is it decreasing?

What’s Next?

Are you ready to discover top quality insights about your brand and grow your brand equity? Email your project specifications to our research experts using Projects at E2Eresearch dot com. We’d love to help you better understand your buyers and your brand to help you turn your enigmas into enlightenment!

Learn more from our case studies

- Stretching Brand Equity into White Spaces Using Data Fusion – A pharmaceutical data analytics case study

- Benchmarking Brand Awareness and Competitive Brand Space – A consumer food survey case study

- Increasing Enrollment Through A More Meaningful Brand Purpose – An education survey case study

Books and Videos You Might Like

- Strategic Brand Management: Building, Measuring, and Managing Brand Equity by Kevin Lane Keller and Vanitha Swaminathan

- The Strategy of Global Branding and Brand Equity by Alvin Lee, Jinchao Yang, Richard Mizerski, and Claire Lambert

- Brand Equity & Advertising: Advertising’s Role in Building Strong Brands by David A. Aaker and Alexander Biel

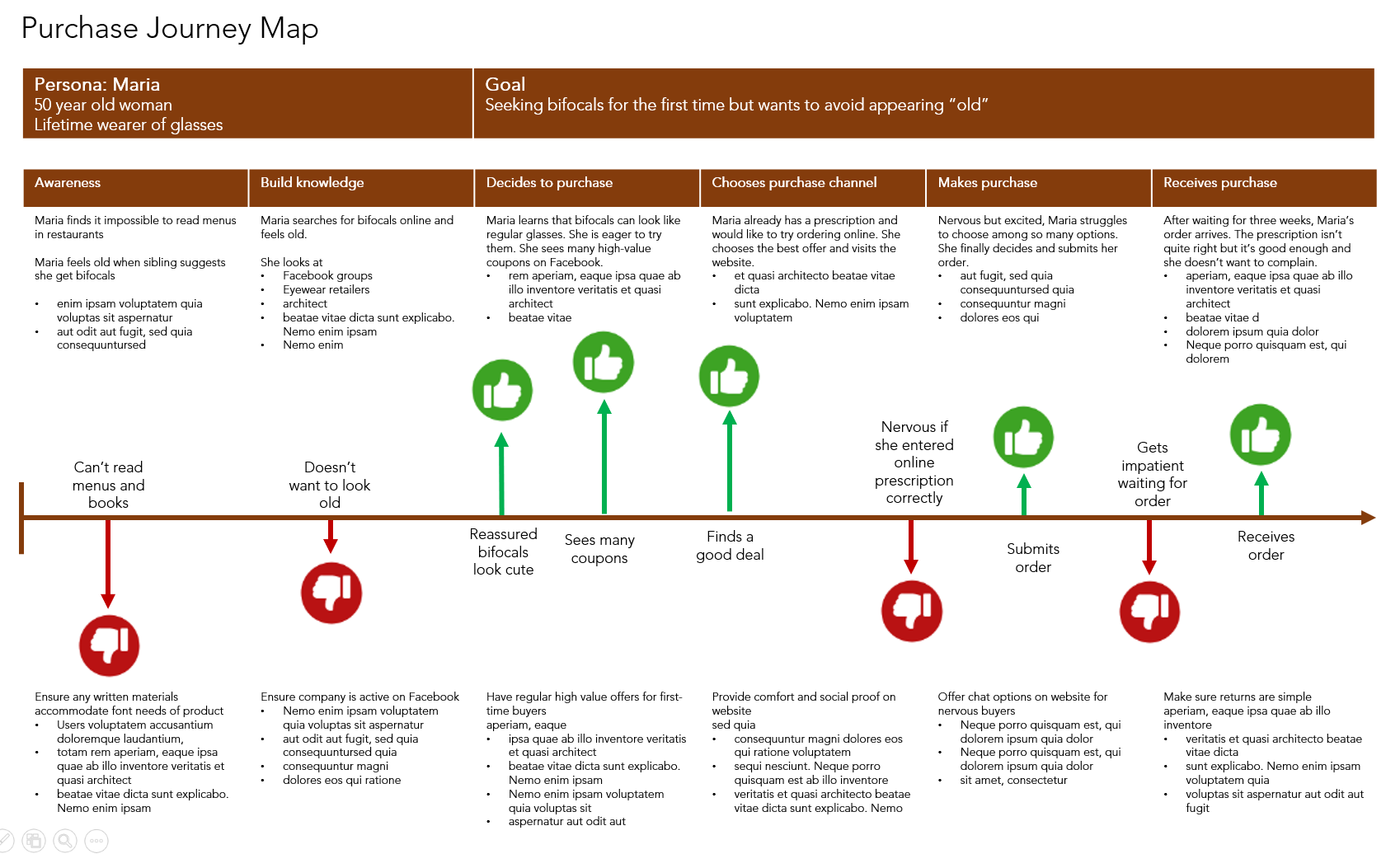

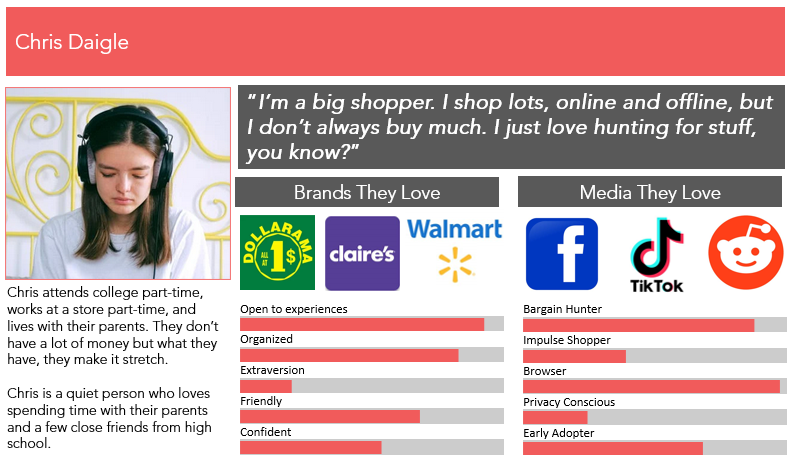

Simply put, personas are short, simple descriptions of a group of targeted people but written as if they were describing one single person. The best personas are grounded in quantitative and qualitative research and summarize the demographics, psychographics, motivations, needs, and goals of those people. You might also see them referred to as Buyer Personas, Customer Personals, Patient Personas, User Personas, or something similar.

Simply put, personas are short, simple descriptions of a group of targeted people but written as if they were describing one single person. The best personas are grounded in quantitative and qualitative research and summarize the demographics, psychographics, motivations, needs, and goals of those people. You might also see them referred to as Buyer Personas, Customer Personals, Patient Personas, User Personas, or something similar. Depending on the size and complexity of your business, you might need 1 or 2 personas or 15 to 20 personas.

Depending on the size and complexity of your business, you might need 1 or 2 personas or 15 to 20 personas.

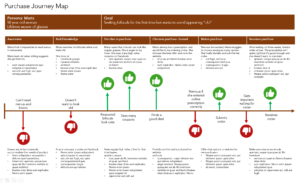

Nearly any journey wherein people progress through a set of stages, interacting with channels or people, over a short or long time frame to accomplish a goal can be mapped. Here are just a few of the more common journey maps that marketers and brand managers use.

Nearly any journey wherein people progress through a set of stages, interacting with channels or people, over a short or long time frame to accomplish a goal can be mapped. Here are just a few of the more common journey maps that marketers and brand managers use.

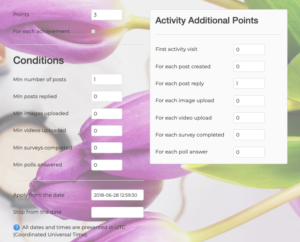

Like any market or consumer research project that intends to generalize valid and reliable findings to a broader population, every insight community needs clear planning, goals, and research objectives that lead to specific outcomes. “Signing up” or “finding lots of members” are not acceptable goals, nor is “getting lots of comments every day.”

Like any market or consumer research project that intends to generalize valid and reliable findings to a broader population, every insight community needs clear planning, goals, and research objectives that lead to specific outcomes. “Signing up” or “finding lots of members” are not acceptable goals, nor is “getting lots of comments every day.”  From focus groups to questionnaires, researchers have many data collection tools to choose from, each with their own benefits. However, insight communities that allow people to log in and out at their own convenience have many benefits for participants. They:

From focus groups to questionnaires, researchers have many data collection tools to choose from, each with their own benefits. However, insight communities that allow people to log in and out at their own convenience have many benefits for participants. They: Communities aren’t a quick alternative to groups or interviews. Even if a community is planned to run over just a couple of days, it requires extensive pre-planning, moderation during those days, and lots of post-project analysis and identification of next steps. Without planning for this investment of time and resources, everyone’s efforts will be lost.

Communities aren’t a quick alternative to groups or interviews. Even if a community is planned to run over just a couple of days, it requires extensive pre-planning, moderation during those days, and lots of post-project analysis and identification of next steps. Without planning for this investment of time and resources, everyone’s efforts will be lost. Insight communities also have clear rules for participants who wish to join and remain part of the community. They may include requirements to:

Insight communities also have clear rules for participants who wish to join and remain part of the community. They may include requirements to: Insight communities can take many forms. Sometimes, they’re just a few days long and focus on one or two specific products. Other times, they can last several months and focus on broad categories.

Insight communities can take many forms. Sometimes, they’re just a few days long and focus on one or two specific products. Other times, they can last several months and focus on broad categories. Online communities help lower costs in different ways. First, longer-term communities can take the place of multiple ad-hoc projects. This eliminates the need to recruit participants multiple times. Further, participants are already ‘trained’ in how research works and need far less time and guidance to navigate the software and complete the tasks.

Online communities help lower costs in different ways. First, longer-term communities can take the place of multiple ad-hoc projects. This eliminates the need to recruit participants multiple times. Further, participants are already ‘trained’ in how research works and need far less time and guidance to navigate the software and complete the tasks.

Traditional questionnaires list out the brand names in alphabetical order and often ask people to assign rank order numbers to them. The most desirable product is assigned the number 1 while the least desirable product is assigned the number 5 or 10 or some other larger number.

Traditional questionnaires list out the brand names in alphabetical order and often ask people to assign rank order numbers to them. The most desirable product is assigned the number 1 while the least desirable product is assigned the number 5 or 10 or some other larger number.

Everyone communicates in different ways. Painters and authors and musicians (and those of us who aspire to be one of those!) find it easier to share opinions and ideas in visual or written or auditory ways. Further, some question types are better at capturing basic facts and straightforward opinions while other question types are better at capturing feelings and emotions.

Everyone communicates in different ways. Painters and authors and musicians (and those of us who aspire to be one of those!) find it easier to share opinions and ideas in visual or written or auditory ways. Further, some question types are better at capturing basic facts and straightforward opinions while other question types are better at capturing feelings and emotions. And of course, what about people who prefer to share their opinions and ideas verbally or visually? Digital devices make it very easy to

And of course, what about people who prefer to share their opinions and ideas verbally or visually? Digital devices make it very easy to  For quantitative researchers running tabulations and statistical analyses day after day, it’s easy to forgot how intimidating math is for many people. Fortunately, our digital devices are ready and willing to help. At the most basic level, researchers can design questions that automatically do the math for participants – no more, “Please make sure your numbers add to 100%.”

For quantitative researchers running tabulations and statistical analyses day after day, it’s easy to forgot how intimidating math is for many people. Fortunately, our digital devices are ready and willing to help. At the most basic level, researchers can design questions that automatically do the math for participants – no more, “Please make sure your numbers add to 100%.”

When people agree to participate in a survey, they know they will be asked to click in circles and boxes, and select items from a list. Unfortunately, they’re often less interested in typing out long explanations of their answers.

When people agree to participate in a survey, they know they will be asked to click in circles and boxes, and select items from a list. Unfortunately, they’re often less interested in typing out long explanations of their answers.