There’s more to creating a successful food or beverage product than selling something you love eating or drinking. Consumers are always on the lookout for food and beverage options that are scrumptious but also better quality, healthier, affordable and easily available.

If you’re hoping to move a product from successful with kids in your household to successful with kids in your country, many questions need to be identified, answered, and acted on. This list of questions focused around the five Ps will ensure you gather the information you need to get there.

Better Understand the Product: Nutrition, sensory, packaging

At the heart of a successful food or beverage business is a carefully researched and designed product that meets the key needs of its target audience – yes, even food and beverages products have key needs. By conducting well designed surveys and product/sensory tests via IHUTs or Central Location Tests, you can understand:

At the heart of a successful food or beverage business is a carefully researched and designed product that meets the key needs of its target audience – yes, even food and beverages products have key needs. By conducting well designed surveys and product/sensory tests via IHUTs or Central Location Tests, you can understand:

- What nutritional, sensory, or emotional needs are your shoppers and consumers trying to meet and what unmet needs need additional development?

- How is the food or beverage used to meet unexpected needs such that new audiences could be targeted? E.g., are slow foods being converted into fast foods, are meat foods being converted into meat-free foods, are solid foods being converted into drinkable foods?

- What features, whether sensory, emotional, packaging or otherwise, of the product are unique within the broader, competitive category and how could they serve as your unique selling points?

- How are the package and eating implements “correctly” and “incorrectly” used suggesting needs for redesign or improvements?

- Does the memorability of your food or beverage require improvements in terms of its sensory features, packaging, branding, colors, or logos?

- Should certain product lines be expanded or reduced based on growing or decreasing market needs?

.

Review a product case study:

- Developing a New Nutritional Pasta Product – A survey + desk research case study

- Identifying An Optimal Set of Flavor Variants to Achieve Incremental Reach – Case Study

- Choosing a Set of Flavors to Minimize Substitutions – A food survey + data analytics case study

- Fine Tuning New Personal Care Products with JAR Analysis – A sensory IHUT case study

- Sentiment and Content Analysis of Qualitative Consumer Comments – A food survey + text analysis case study

Better Understand the People: Cooks, bakers, shoppers, eaters, snackers, caregivers, meal planners, meal preppers

Before a new food or beverage product is even launched, it’s important to understand the perceptions of all key stakeholders. From eaters to shoppers and those who will be preparing or recommending the product, it’s imperative that each group understand the benefits and drawbacks of the product to ensure maximum success. Using questionnaires, business intelligence, and secondary research, you can understand a number of key questions:

Before a new food or beverage product is even launched, it’s important to understand the perceptions of all key stakeholders. From eaters to shoppers and those who will be preparing or recommending the product, it’s imperative that each group understand the benefits and drawbacks of the product to ensure maximum success. Using questionnaires, business intelligence, and secondary research, you can understand a number of key questions:

- Who are your target shoppers and consumers in terms of their demographic, psychographic, family, social, economic, and health characteristics?

- Which stakeholders come into contact with your food or beverage e.g., caregivers, shoppers, cooks, bakers, eaters, snackers, meal planners, meal preppers?

- Which stakeholders will influence your target audience to consider using or buying food and beverages?

- What does each stakeholder group need, want, feel, and prefer, and how do their needs conflict with each other?

- What drives each key stakeholder group to choose, use, buy, and recommend your brand vs competitive brands?

- How does the shopper journey evolve from discovering a need through to shopping, comparing, and buying while also considering nutritional, emotional, financial, and social needs at each stage?

- What personal histories and experiences do people have with the food or beverage product and category including with your brand and competitive brands?

.

Review a stakeholder case study

- Measuring Consumer Preferences for Successful Ready-To-Eat Development | A Sensory Research Case Study

- Identifying Target Audiences of Two New Tea Variants – An IHUT + JAR analysis case study

Better Understand Placement, Industry, and Competitive Market Space

Every food and beverage product exists within a broad ecosystem of competitive brands and companies. By conducting engaging questionnaires or secondary desk research, you can understand a wide range of business problems such as:

Every food and beverage product exists within a broad ecosystem of competitive brands and companies. By conducting engaging questionnaires or secondary desk research, you can understand a wide range of business problems such as:

- Who are your primary and secondary competitors locally, globally, and virtually?

- What sensory, product, physical, emotional, social, and economic needs is the market failing to address?

- How has the competitive landscape changed over the last year and how might the food and beverage category evolve over the next 3 to 5 years within your region and potential expansion regions?

- Where are the white spaces to develop new food and beverages, or new service locations?

- Can secondary data help you understand how large your existing market is and how large it could be while still remaining profitable?

.

Review a market case study

- Benchmarking Brand Awareness and Competitive Brand Space – A consumer food survey case study

- Tracking Customer Satisfaction Across 8 Countries – A consumer food survey case study

- Creating a Beverage Launch Strategy in a Competitive Market – A beverage desk research case study

Better Understand Promotions, Advertising, and Campaigns

With a great food or beverage innovation and a well understand target audience, a marketing campaign is often required to reach out to a wider audience and introduce the masses to your offering. Using questionnaires or data analytics, a number of key questions can be answered:

With a great food or beverage innovation and a well understand target audience, a marketing campaign is often required to reach out to a wider audience and introduce the masses to your offering. Using questionnaires or data analytics, a number of key questions can be answered:

- Which online and offline information channels do your consumers and shoppers use to learn about new food and beverages, gather recommendations, or make purchases?

- What types of messaging would be most successful at reaching your target audience and differentiating your product from competitive products?

- What types of ads would be most effective with each of your audience segments when considering likability, meaningfulness, believability and the likelihood to act?

- What types of food and beverage marketing campaigns are more likely to be successful?

- What types of brands, companies, or influencers would your consumers and buyers like to see incorporated in an integrated marketing campaign?

- Which food and beverage concepts are most memorable and would generate the most action from your target audience?

.

Review an advertising case study:

- Evaluating the Effectiveness of a Campaign with Brand and Message Recall – A consumer media survey case study

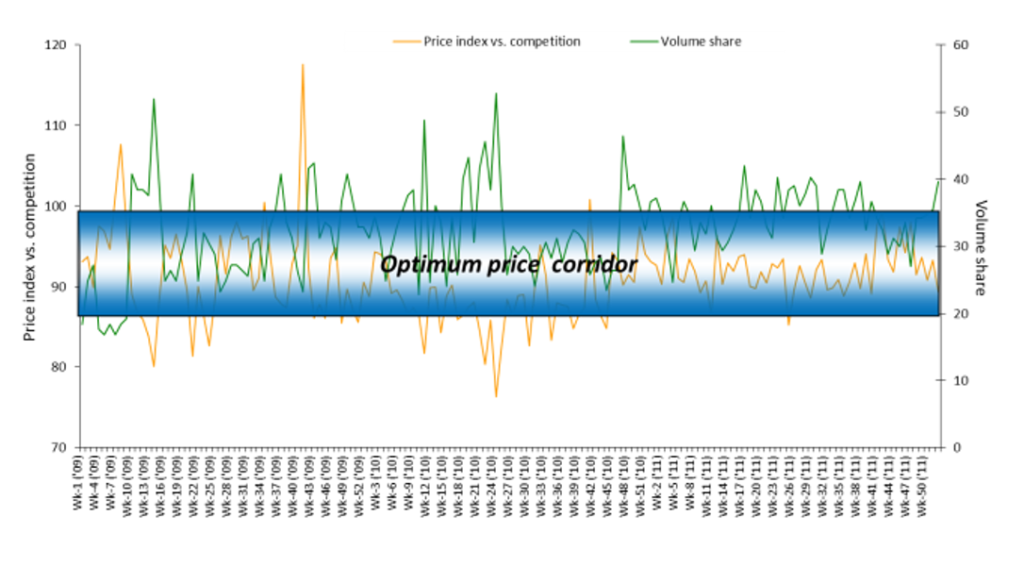

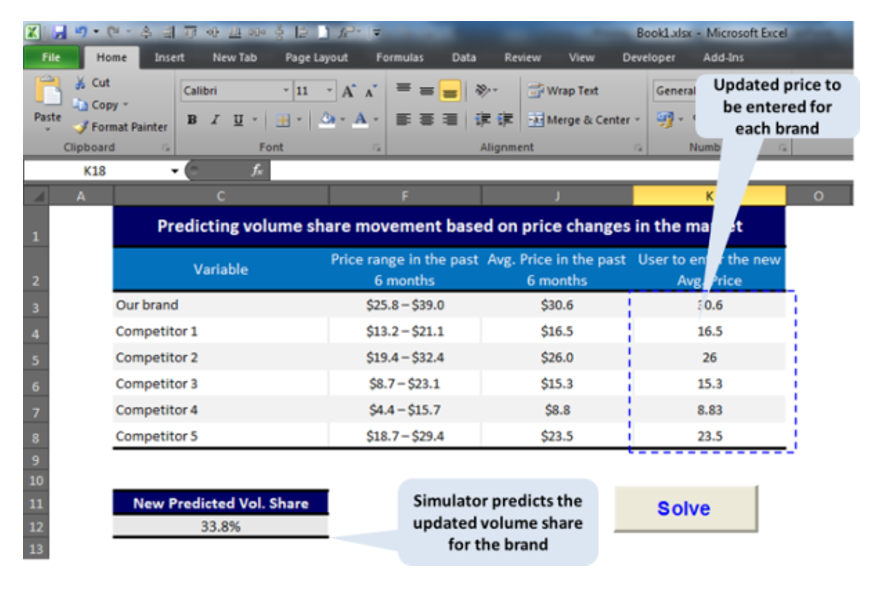

- Identifying Optimum Price Corridors to Predict Volume Share – An advertising price simulator case study

Create A Fair and Profitable Pricing Strategy

There is more to pricing than picking a number that will generate profit. A price that is too high can reduce recommendations from friends and family. A price that is too low leaves achievable profit on the table. A final price can only be determined by understanding your true profit margin, market pricing, and stakeholder needs. To build the most effective pricing strategy for your new food or beverage, conduct the appropriate surveys, interviews, and secondary research first.

There is more to pricing than picking a number that will generate profit. A price that is too high can reduce recommendations from friends and family. A price that is too low leaves achievable profit on the table. A final price can only be determined by understanding your true profit margin, market pricing, and stakeholder needs. To build the most effective pricing strategy for your new food or beverage, conduct the appropriate surveys, interviews, and secondary research first.

- Based on secondary research, how are competitive products on the market currently priced?

- Using questionnaire data, what type of pricing strategy is most appealing to shoppers?

- What type of pricing strategy would facilitate product recommendations from influential friends and family?

- Which user segment has the least and the greatest revenue potential?

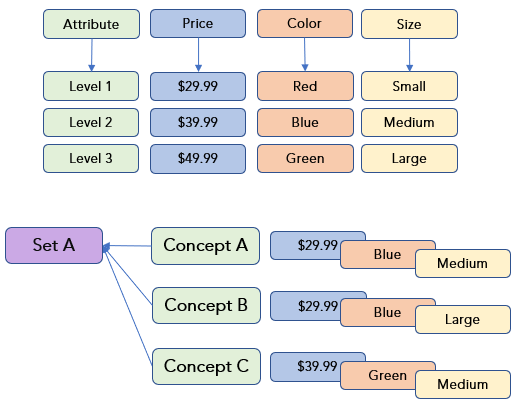

- Based on a Conjoint or MaxDiff questionnaire, which product features drive higher and lower prices?

- What type of pricing strategy is fair and accessible versus out of reach to lower income people vs higher income people?

.

Review a pricing case study

- Optimizing Trade Promotion Spends with a Pricing Simulator – A food business analytics and price simulator case study

- Improving Operational Effectiveness at a CPG Company – A retail B2B survey case study

- Identifying Optimum Price Corridors to Predict Volume Share – An advertising price simulator case study

Conclusion

Creating a successful food or beverage product requires a foundation of well designed and executed research coupled with well actioned research results. Whether you’re tasked with supporting the growth of an innovative cannabis beverage or helping a company understand the different needs of buyers and consumers, our team has years of experience helping researchers, marketers, and brand managers generate great quality food and beverage data and insights. Please email your project specifications to our research experts using Projects at E2Eresearch dot com. We’d love to help you convert your enigmas to enlightenment!

Learn at upcoming food and beverage industry conferences

- Food and Beverages, London, March 9 to 10, 2022

- International Conference on Food Marketing and Tourism, London, March 11-12, 2022

- Food Marketing Conference, Michigan, March 22 to 23, 2022

- Food 2.0 Conference, Las Vegas, April 11 to 13, 2022

- Beverage Forum, Chicago, April 28 to 29, 2022

- International Conference on Food Marketing and Tourism, Netherlands, May 16-17, 2022

- Food & Drink Trends & Innovations, London, May 18, 2022

- Food and Beverage Packaging, Spain, June 13 to 14

- International Food Marketing Research Symposium, Texas, June 14 to 16, 2022

- The Ecommerce & Digital Marketing Conference for Food & Beverage, Austin, July 25 to 26, 2022

- Food Marketing Institute Annual Business Conference, Chicago, September 11 to 14, 2022

Listen to some great podcasts about food and beverage marketing

- A Fresh Perspective Food News with Jenny Kolzer (Player.fm)

- Beyond the Shelf

- Dennis Knows Food with Luke LaBree (Player.fm)

- Food Biz Wiz with Allie Ball

- Real Food Brands Marketing Podcast with Katie Mleziva (Spotify)

- Restaurant Marketing School with Josh Kopel (Player.fm)

- Restauranttopia with David Ross, Brian Seitz, and Anthony Hamilton

- Secret Sauce – Restaurant Marketing Podcast with James Eling (Spotify)

- The Experiential Table with Cynthia Samanian (Player.fm)

- The Insatiable Appetite

- The Virginia Foodie with Georgiana Dearing (Player.fm)

A lot of market research starts by truly understanding a specific audience. Who are they – what are their hobbies, where do they live, where do they work, what does their family look like? It’s really easy to calculate a median age and the percentage of customers who are female but the last few years have taught us a lot about intersectionality – it’s not just “women,” it’s “disabled Black women.” In the research world, we understand this as customer segments or personas.

A lot of market research starts by truly understanding a specific audience. Who are they – what are their hobbies, where do they live, where do they work, what does their family look like? It’s really easy to calculate a median age and the percentage of customers who are female but the last few years have taught us a lot about intersectionality – it’s not just “women,” it’s “disabled Black women.” In the research world, we understand this as customer segments or personas. If you’ve written a questionnaire before, you know how important this tip is. Sure, you could write a questionnaire as if you were Charles Dickens showing off his stunning, grammatically correct 200-word sentences with multiple, embedded clauses.

If you’ve written a questionnaire before, you know how important this tip is. Sure, you could write a questionnaire as if you were Charles Dickens showing off his stunning, grammatically correct 200-word sentences with multiple, embedded clauses. How do you get colleagues to share your research? Easy! Well, it’s not that easy. Storytelling is a necessary skill that will carry your research results throughout the company. Let people know what is exciting about the insights, how they could be used to reach consumers in unexpected ways, how they could personally benefit from understanding the results.

How do you get colleagues to share your research? Easy! Well, it’s not that easy. Storytelling is a necessary skill that will carry your research results throughout the company. Let people know what is exciting about the insights, how they could be used to reach consumers in unexpected ways, how they could personally benefit from understanding the results. You could build and execute a 5-year research plan.

You could build and execute a 5-year research plan.

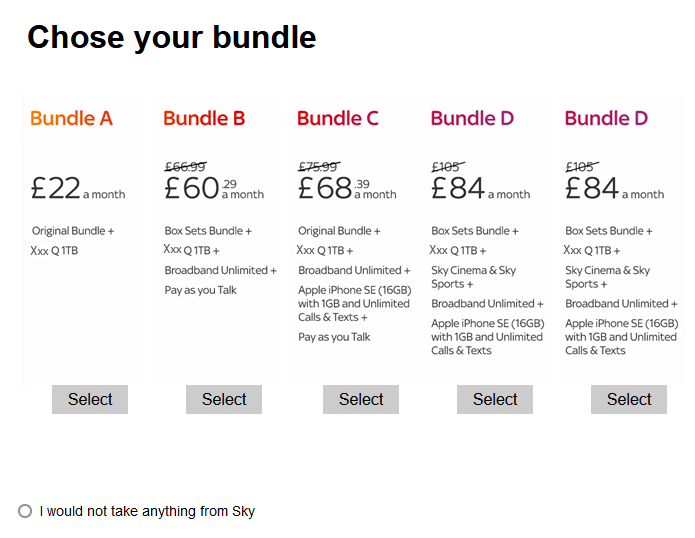

Include competitors: The real market includes competitors, often many. People don’t shop for single brands in isolation and neither should they answer your conjoint questions in isolation. Include at least one key competitor in your test, and preferably at least two. Further, if your brand is relatively unknown, you may wish to incorporate a competitor that is also relatively unknown.

Include competitors: The real market includes competitors, often many. People don’t shop for single brands in isolation and neither should they answer your conjoint questions in isolation. Include at least one key competitor in your test, and preferably at least two. Further, if your brand is relatively unknown, you may wish to incorporate a competitor that is also relatively unknown. Use imagery: We already know that a conjoint task can be cognitively demanding. That’s why imagery helps. Not only does it help people to visualize the product on the shelf amongst it’s competitive brands, it also helps to create a more visually appealing task (mmmmm cookies!). If you can’t provide an image of your product, find other ways to incorporate visuals in the questionnaire.

Use imagery: We already know that a conjoint task can be cognitively demanding. That’s why imagery helps. Not only does it help people to visualize the product on the shelf amongst it’s competitive brands, it also helps to create a more visually appealing task (mmmmm cookies!). If you can’t provide an image of your product, find other ways to incorporate visuals in the questionnaire.